Home >> Blog >> Credit Rating vs. Credit Score: What’s the Difference?

Credit Rating vs. Credit Score: What’s the Difference?

Table of Contents

- What is a Credit Score?

- Who gets a credit score?

- Who assigns credit scores?

- What is included in a credit score?

- Why is the CIBIL score important?

- What is a Credit Rating?

- Who is responsible for these ratings?

- What does a credit rating look like?

- Credit Score & Credit Rating: Comparison

- Why Banks Check Credit Score

- Why Investors Check Credit Rating

- What Does It Mean to Have a Good Credit Score?

- What goes into a credit score?

- What affects your CIBIL score?

- What Are The CIBIL Score Improvement Tips

- Why Do Companies Need A Credit Rating

- Do They Impact Each Other?

- Confusion: Why do people mix them up?

- Final Credit Score Difference

- Conclusion

You will very certainly come across the terms credit rating and credit score whenever you borrow money, such as when you apply for a home loan, credit cards, or any other type of business loan. Though some believe that they are the same thing, they are not. Credit rating vs credit score are terms that describe different concepts, used for different purposes, and by different institutions, depending on the entity involved.

Making wise financial decisions requires knowledge of this. Additionally, understanding these ideas improves your chances of getting a loan that is both accessible and reasonably priced.

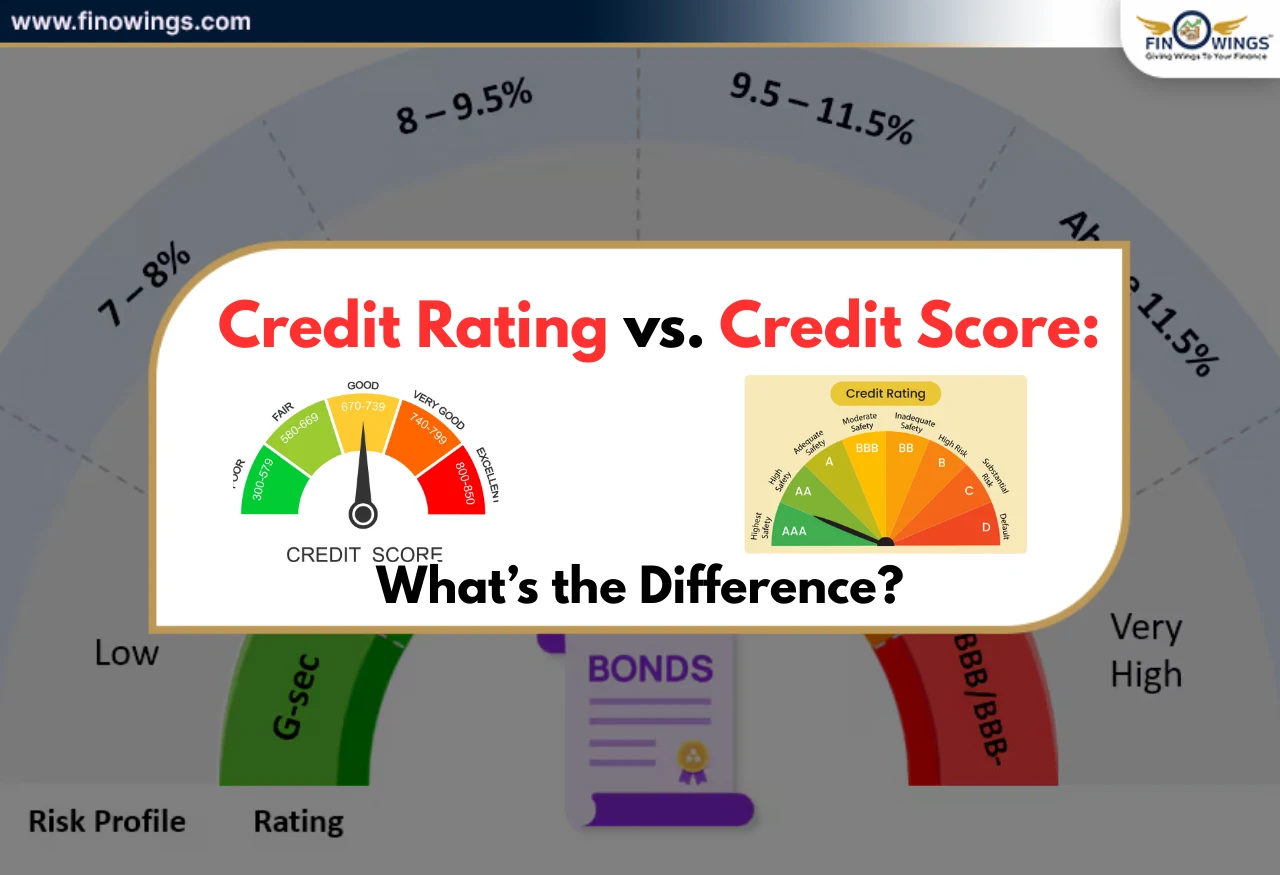

What is a Credit Score?

A credit score is a three-digit number, and generally, it is how creditworthy you are. In India, the most familiar score is that of CIBIL score which is on a scale of 300 to 900. The higher the score, the better the chance one will get the loan.

Who gets a credit score?

These are most commonly the individuals.

Who assigns credit scores?

Credit bureaus, including:

- CIBIL

- Experian

- Equifax

- CRIF Highmark

What is included in a credit score?

A credit score is calculated based on:

- Your repayment history

- Loan EMIs

- Payment history on credit cards

- Level of credit use

- Total inquiries

- Active debt

Why is the CIBIL score important?

Before giving these loans:

- Home loan

- Personal loan

- Credit card

- Consumer loan

Banks look at your CIBIL report and score.

General guideline:

Score above 750 = best approval chances

What is a Credit Rating?

Credit rating concerns companies, governments, or large corporate debt, not individuals.

Credit rating Meaning:

It indicates repayment capacity and the company's overall financial strength.

Who is responsible for these ratings?

The following rating crediting companies:

- CRISIL

- CARE

- ICRA

- Moody’s

- S&P.

What does a credit rating look like?

Credit ratings are not expressed in numerical form but in alphanumeric form, such as:

- AAA

- AA+

- AA

- BBB

- BB

- C

C or D is lowest, AAA is highest.

Credit Score & Credit Rating: Comparison

|

Factors |

Credit Score |

Credit Rating |

|

Used for |

Individuals |

Companies & governments |

|

Agency |

CIBIL/Experian |

CRISIL/ICRA |

|

Format |

300-900 |

AAA/AA/BBB |

|

Purpose |

Personal borrowing |

Corporate borrowing |

|

Evaluates |

Personal credit history |

The company’s repayment strength |

|

Affects |

Loans & credit cards |

Debt investment decisions |

Example

Credit score: Not paying a bill could cause your CIBIL score to decrease.

Credit rating: AA rating may be decreased to BBB if interest on bonds is not paid.

Why Banks Check Credit Score

Before offering credit, banks need to know if you, personally, have a history of paying back loans reliably. This helps banks avoid loans that may not be paid back and decide on loan:

- approval

- amount

- interest rate.

Why Investors Check Credit Rating

Investors check the credit rating first when buying:

- bonds

- NCD

- corp. debt

This is because the rating indicates how financially stable a company is. To lenders, notes with high interest rates are high risk. Ones with lower interest rates are lower risk.

What Does It Mean to Have a Good Credit Score?

A good credit score means:

- You pay your loans.

- You show responsible credit behaviour

- You have a history of good borrowing

- You pay your loans on time and don’t delay

- You show responsible usage of credit.

Range:

-

750 and above. This is considered excellent.

-

650 to 750 is average.

-

Below 650 and it is considered risky.

What goes into a credit score?

A report often contains:

- loans you have taken

- EMIs you have

- unpaid payments

- a history of credit you have

- payments you have made to complete a loan.

A credit score is so important because it can help or hurt you in many aspects of life. These include

- Home loans

- Personal loans

- Credit cards

- Buy Now Pay Later (BNPL)

- Education loans

- Business loans

Fintech companies also look at your score to approve micro loans.

What affects your CIBIL score?

|

Factor |

Impact |

|

Late payments |

Very high |

|

High credit card usage |

High |

|

Too many loan inquiries |

High |

|

Old debt history |

Positive |

|

Credit mix |

Positive |

|

Loan defaults |

Very high negative |

What Are The CIBIL Score Improvement Tips

-

Credit card bills should be paid on schedule.

-

Pay down the debt.

-

Don't take on new credit.

-

Keep credit usage under 30%.

-

Check your report at regular intervals.

Why Do Companies Need A Credit Rating

Companies need credit ratings because they take loans from banks and other investors.

Companies with rated credit may:

-

Obtain funds at lower interest rates.

-

Easily sell their bonds.

-

Keep good relationships with their investors.

Do They Impact Each Other?

No. A company's credit rating does NOT affect your CIBIL score. Your personal credit score does NOT affect the company you invest in. They are entirely separate.

Real-Life Example

Example 1:

If you have a CIBIL score of 820, you will be able to secure home loans at a cheaper rate.

Example 2:

You have an AAA credit rating and investors think it's safe for AAA corporate bonds.

Confusion: Why do people mix them up?

Both are about borrowing and repayment ability, but one is about Individuals and Companies.

Final Credit Score Difference

|

Credit Score |

Credit Rating |

|

For people |

For organizations |

|

Shows personal risk |

Shows corporate risk |

|

Affects personal loans |

Affects corporate borrowing |

|

CIBIL score |

CRISIL rating |

Should you check your credit score regularly? Yes, because mistakes do happen in credit reports. If your credit report has an inaccurate loan detail, your score will drop and that can be very unfair.

Tips

-

Pay on time.

-

Don't get too many cards.

-

Keep some credit accounts for a long time.

-

Don't use too much credit.

Conclusion

Credit score means your personal financial behaviour. Credit rating means a company’s ability to repay debt. Both are important for different things. Keep checking your credit report.

DISCLAIMER: This blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

A credit score applies to individuals and ranges from 300–900, while a credit rating applies to companies or governments and is expressed in grades like AAA, AA, BBB, etc. They are used for different lending decisions.

No. A company’s credit rating has no impact on your personal credit score. Likewise, your credit score does not affect the company you invest in.

A credit score above 750 is considered excellent and improves approval chances for home loans, personal loans, and credit cards.

Credit scores are assigned by credit bureaus such as CIBIL, Experian, Equifax, and CRIF Highmark. Credit ratings are given by agencies like CRISIL, ICRA, CARE, Moody’s, and S&P.

Pay bills on time, keep credit utilization under 30%, avoid excessive loan inquiries, maintain old credit accounts, and clear outstanding EMIs regularly.