Home >> Blog >> Credit Card Application Rejected? 5 Common Reasons

Credit Card Application Rejected? 5 Common Reasons

Table of Contents

Receiving your first credit card is often a major milestone in the journey towards financial independence. Whether it's for online shopping, travel perks, cash back, or simply propelling your credit history into orbit, credit cards are indispensable financial instruments in India.

But what happens if your credit card is refused? This is much more common than one may think, and every year, credit card rejections impact hundreds of thousands of Indian citizens, though in many cases, there's no obvious explanation. Most financial institutions will send an applicant a one-size-fits-all rejection letter stating, "Your application does not satisfy our predetermined corporate requirements."

In this article, we will analyse the primary causes for credit card decline and provide some credit card tips that can increase your chances of being accepted in the future.

Why Do Credit Card Applications Get Denied?

To begin, we need to analyse the structure of our financial institutions. When applying for a credit card in India, banks analyse your potential risk. They evaluate:

-

Your ability to pay back your debt.

-

Your financial stability.

-

Your financial discipline.

Factors indicating risk might show up in your profile and lead to credit card rejections.

Credit Card Rejection Reasons

Let’s look at the 5 most common reasons credit card applications get turned down.

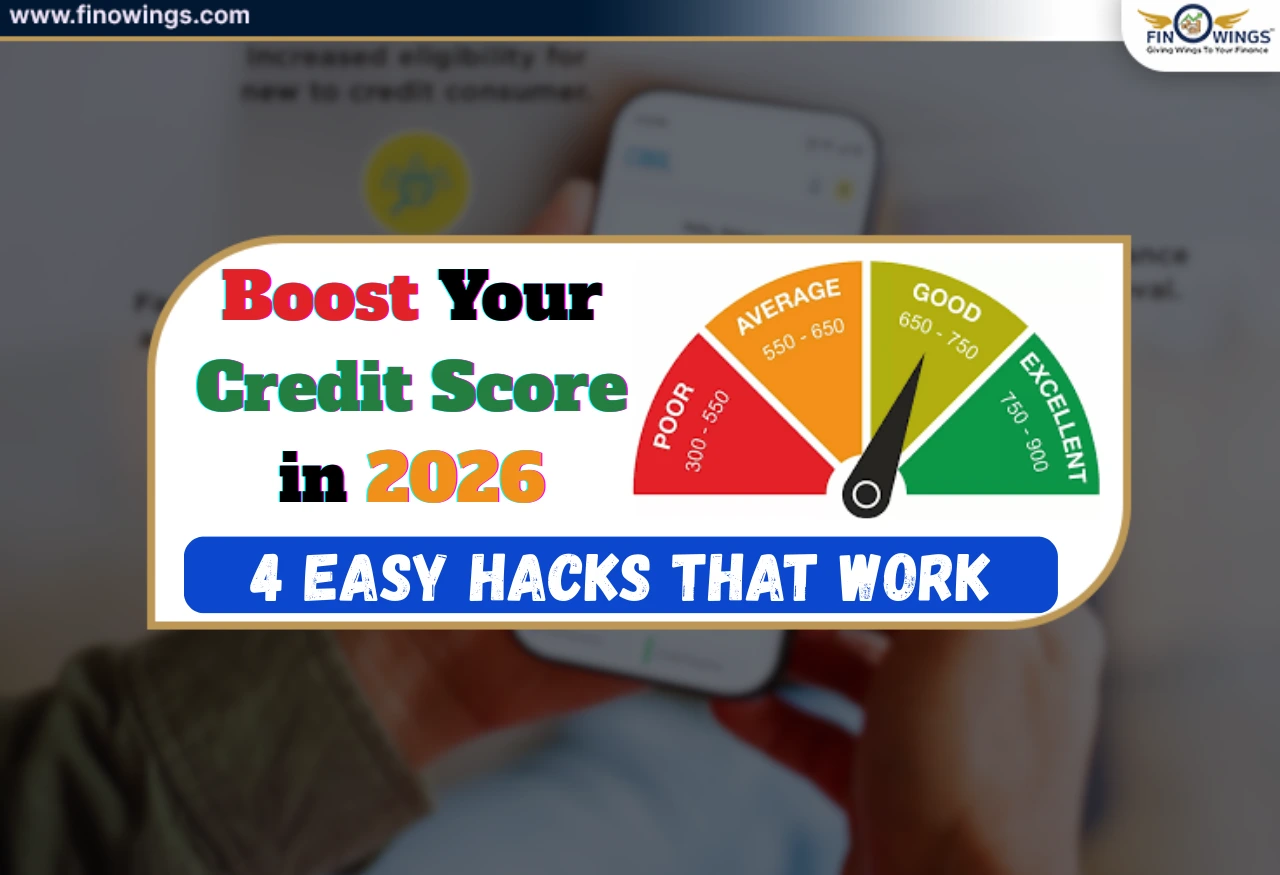

1. Low or No Credit Score

What is a Credit Score?

One of the biggest reasons people's credit card applications get rejected is a lack of credit score or a low credit score.

Credit Score Breakdown

Credit scores in India range between 300 and 900and are calculated by credit bureaus like CIBIL, Experian and Equifax. Here’s how credit scores in India affect chances of credit card approval:

750+: Excellent chances

700–749: Good chances

650–699: Limited options

Below 650: High risk of rejection

No credit history: Uncertain chances, often rejected.

First-time credit card applicants often get credit card application rejections because banks lack sufficient data to evaluate them.

Investment Behaviour

To move forward with building your credit, you can start with a secured credit card where the security deposit is FD- backed. Purchase a small consumer loan and keep up with the timely payments to build some positive credit history.

Keep credit card balances low (<30%) to show good credit card behaviour.

2. High Credit Usage or Current Debt

When you have debt, it’s important to note that high credit usage can still work against you even if your credit score is good.

What is Credit Usage?

Using some of your available credit is normal, but you must stay within reasonable amounts of credit you are using. Good example: If you have a credit limit of 100,000 rupees and you use 80,000 rupees in credit, your credit usage is 80%. This is too high.

Most banks will consider you a lower risk if you:

-

Use 30% or less of your available credit limit.

-

Are not regularly maxing out your credit cards.

-

Using a high percentage of your available credit is a sign of poor money management skills and can increase your chances of being denied for a credit card.

Improvement Measures

-

Refrain from using the minimum payment.

-

Spread out your credit card applications.

-

Pay off your balances.

3. Insufficient or Erratic Income

Income is an important aspect of obtaining credit cards in India, especially the unsecured type.

Reasons For Income-Related Rejections

-

Income is insufficient for the bank’s minimum criteria.

-

Income is inconsistent (and the freelancer has no proof).

-

Recently changed jobs.

-

Employment history is lacking.

Each institution has its own criteria. For example:

Entry-level cards: ₹15,000–₹25,000/month

Premium cards: ₹75,000–₹1,00,000+/month

Income mismatches can result in a rejection of the credit card application.

Documents Required By Most Banks

-

Most recent salary slips.

-

Form 16 / Individual Tax Return (ITR).

-

Bank statements.

Tips For Approval of a Credit Card

-

Card applications should be limited to those commensurate with your income class.

-

Freelancers should provide ITR + bank statements.

-

Do not apply right after a job change.

4. Too Many Recent Requests for Credit

When trying to obtain cards or loans, requests made in a compressed time frame can significantly harm prospects.

Reasons For Bank Application Rejections

Each application results in a hard inquiry on the credit history. Increased inquiries indicate:

-

Thirst for credit.

-

Unstable finances.

This is often overlooked as a reason for credit card refusals.

Best Approach

-

Wait 3-6 months before applications.

-

Do not apply for cards and loans at the same time.

-

Monitor your credit report for inquiries.

-

Keep in mind that frequent applications, even with a strong credit score, can result in denials.

5. Mistakes in Application or Credit Report

Your credit card could get rejected and sometimes it is not even your fault. Mistakes often include:

-

Incorrect card number or address.

-

Name mismatch.

-

Incorrect entries (like your annual income).

-

Mistakes in your credit history (like reports of late payments).

Automated systems can reject your application because of a small mistake.

What You Should Do

-

Be sure to check your application for errors.

-

Check your credit history every year.

-

Go to the credit bureau if there are mistakes.

-

Fixing mistakes can improve your chances of getting approved.

How to Increase Chances of Getting a Credit Card in India

If your India credit card application was rejected, there is no reason to panic and you can increase your chances of getting a credit card using these tips.

1. Check Your Credit Report

Avoid applying for credit cards just because you want to get one without actually knowing the details of your credit score and report.

2. Get Starter or Secured Credit Cards

Secured cards are easier to obtain and help improve your credit score.

3. Be Financially Responsible

-

Make sure you pay your debts and bills on time.

-

Use a small portion of your credit.

-

Don't take on a large loan.

4. Make Sure Your Card Matches Your Financial Situation

If you don't have sufficient income or good credit, don't apply for a high-tier card.

5. Wait Before Reapplying

After being rejected by a bank, you should usually wait 90 days before applying again.

Final Thoughts

It is always frustrating to receive a credit card application rejected response, but you can always try again. Most credit card rejection reasons can be easily addressed. Instead of guessing, try to ensure that you are working on gaining a credit score for credit card approval, knowing and accepting why the credit card was rejected, and following helpful credit card approval tips.

Once you have worked on all of the above, getting approved for the best credit cards in India should be easier.

Author

Frequently Asked Questions

Even with a good credit score, your credit card application can be rejected due to high credit utilisation, unstable income, too many recent credit inquiries, internal bank policies, or mismatch in application details.

You should ideally wait 90 days before reapplying for a credit card after rejection. Applying too frequently leads to multiple hard inquiries, which further reduce approval chances.

Most banks prefer a credit score of 700 or above. Scores below 650 significantly increase rejection risk, while applicants with no credit history often need secured or starter credit cards.

Yes, but options are limited. You can apply for secured credit cards, FD-backed credit cards, or entry-level cards. Freelancers can use ITR and bank statements as income proof.

Yes. Every credit card application creates a hard inquiry, and multiple rejections in a short period can negatively impact your credit score and signal financial stress to lenders.