Home >> IPO >> GNG Electronics IPO: Date, Overview, And GMP

GNG Electronics IPO: Date, Overview, And GMP

Table of Contents

- GNG Electronics IPO - Complete Overview

- GNG Electronics IPO Details

- Company Financial

- The Objective of The Issue

- Peers of GNG Electronics Ltd.

- Evaluation

- IPO's Strengths

- IPO’s Weaknesses

- Promoters And Management of Smartworks Coworking Ltd.

- GNG Electronics IPO Lead Managers

- Dividend Policy

- Conclusion

GNG Electronics IPO - Complete Overview

GNG Electronics IPO, a Mainboard IPO, is a book-built issue of Rs. 460.43 Cr (1.95 Cr Shares) by GNG Electronics Limited. The company was established in 2006 and undertakes the refurbishing of laptops and desktops as well as ICT Devices on a global level and within India. The company was one of the earliest players in the refurbishment industry to expand its reach to the USA, Europe, Africa, and the UAE.

The brand “Electronics Bazaar” was introduced by the company, which also includes warranty-based servicing apart from sourcing, selling, and even post-sale support for ICT devices, offering comprehensive support.

In addition to ITAD and e-waste management, the company provides warranties, doorstep services, on-site installations, flexible payment terms, effortless upgrades, guaranteed buyback programmes for refurbished ICT Devices, and other bespoke value-added services.

With respect to laptop and desktop buybacks, GNG Electronics assists large format retail stores like Vijay Sales (India) Private Limited (“Vijay Sales”) and OEM brand stores like HP India Sales Private Limited (“HP”) and Lenovo Global Technology (India) Private Limited (“Lenovo”) through tailor-made solutions enabling these businesses to maintain efficient and customer-friendly buyback systems easing out the customer interactions for purchasing new devices.

As of 31 March 2025, the company has a sales network covering 38 countries, selling refurbished ICT devices. GNG Electronics’ sales network comprises 4,154 touchpoints in India and globally, as of 31 March 2025.

This new IPO is to be launched on 23 July 2025, and the initial public offering of this upcoming IPO will end on 25 July 2025.

If you want to apply for the IPO, click to open a Demat Account.

GNG Electronics IPO Details

The Rs. 460.43 crore mainline IPO comprises a fresh issue of 1.69 crore shares (Rs. 400 Cr) and an offer for sale (OFS) of 0.26 crore shares (Rs. 60.44 Cr).

The IPO listing date is on Wednesday, 30 July 2025, and it will be listed at BSE and NSE. GNG Electronics IPO price band is Rs. 225 to Rs. 237 for each Share.

Company Financial

(Amount in Cr)

|

Period |

31 Mar 2025 |

31 Mar 2024 |

31 Mar 2023 |

|

Total Assets |

719.46 |

585.82 |

285.50 |

|

Total Revenue |

1,420.37 |

1,143.80 |

662.79 |

|

PAT |

69.03 |

52.31 |

32.43 |

|

Net Worth |

226.46 |

163.14 |

111.60 |

|

Reserves and Surplus |

176.61 |

132.68 |

81.13 |

|

Borrowings |

446.92 |

322.33 |

152.02 |

Cash Flows

The cash flows for various activities are shown below:

(Amount in millions)

|

Net Cash Flow In Multiple Activities |

31 Mar 2025 |

31 Mar 2024 |

31 Mar 2023 |

|

Net Cash Flow Operating Activities |

245.25 |

974.57 |

249.59 |

|

Net Cash Flow Investing Activities |

26.15 |

(280.83) |

(11.15) |

|

Net Cash Flow Financing Activities |

(342.64) |

(288.98) |

(175.65) |

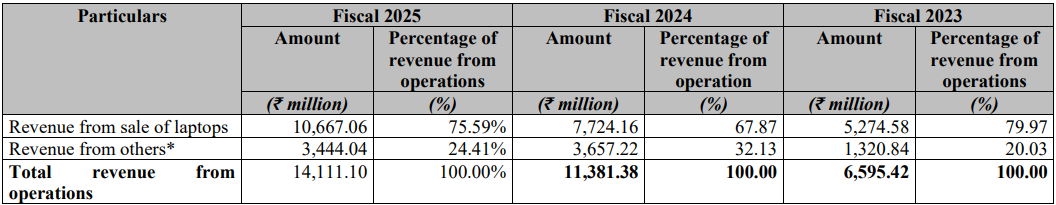

Revenue from Operations Breakdown

Sales-wise Revenue Bifurcation

(Source RHP)

The Objective of The Issue

-

Prepayment and/or partial or complete repayment of all or a portion of specific outstanding borrowings obtained by the Company and Electronics Bazaar FZC, the material subsidiary.

-

General corporate purposes.

Click to check the IPO application status.

Detailed Video

Peers of GNG Electronics Ltd.

|

Company Name |

Face Value (Rs.) |

EPS (Rs.) |

P/E (x) |

|

Newjaisa Technologies Limited |

10 |

-0.32 |

NA |

Evaluation

GNG IPO price is between Rs. 225 to Rs. 237 for each Share.

Evaluation of P/E Ratio

Considering the period of FY 2025, with an EPS of Rs. 7.09 from the last year, the resulting P/E ratio is 33.42x.

Considering the weighted EPS of Rs. 5.89 for the last three years, the P/E ratio is 40.23x.

Explore the Anthem Biosciences IPO, whose allotment status is now available.

Comparative Analysis With Listed Peers

The average P/E Ratio of the industry is NA because of the negative EPS of its only listed peer, Newjaisa Technologies Limited.

IPO's Strengths

-

GNG Electronics has business outlets all over the country, which is complemented by its broad service network, ensuring customer satisfaction.

-

The company diversifies its product offering by manufacturing LED TVs and smart TVs, thus minimising reliance on a single product line.

-

GNG Electronics has modern manufacturing facilities, which enhance cost effectiveness, enable superior control on quality, as well as expedite the product development and delivery cycles.

IPO’s Weaknesses

-

A significant share of revenue relies on a limited group of customers. The loss of any major customer could have severe adverse effects on revenue.

-

GNG has an imported components dependency, mainly drawing from Chinese suppliers, which increases the risk the business faces due to forex changes or geopolitical conflicts.

-

There is a stark increase in the number of competing businesses in the field of electronics, both domestic and foreign, which in turn increases the competitiveness of the market and brings about pricing and margin reductions.

GNG Electronics IPO GMP

GNG Electronics IPO GMP today has not started yet as of 18 July 2025, while writing this information.

GNG Electronics IPO Timetable (Tentative)

The IPO open date is from Jul 23 to Jul 25, with IPO allotment on Jul 28, refund initiation on Jul 29, and listing on Wednesday, Jul 30, 2025.

|

Events |

Date |

|

IPO Opening Date |

Jul 23, 2025 |

|

IPO Closing Date |

Jul 25, 2025 |

|

IPO Allotment Date |

Jul 28, 2025 |

|

Refund Initiation |

Jul 29, 2025 |

|

IPO Listing Date |

Jul 30, 2025 |

GNG Electronics IPO Details

The IPO with a face value of Rs. 2 per Share offers a total issue size of 1,94,27,637 Shares (Rs. 460.43 Cr) and will be listed at BSE and NSE.

|

IPO Opening & Closing Date |

Jul 23, 2025 to Jul 25, 2025 |

|

Face Value |

Rs. 02 per Share |

|

Issue Price |

Rs. 225 to Rs. 237 |

|

Lot Size |

63 Shares |

|

Issue Size |

1,94,27,637 Shares (Rs. 460.43 Cr) |

|

Offer for Sale |

25,50,000 Shares (Rs. 60.44 Cr) |

|

Fresh Issue |

1,68,77,637 Shares (Rs. 400 Cr) |

|

Listing At |

BSE, NSE |

|

Issue Type |

Book Built Issue IPO |

|

Registrar |

Bigshare Services Pvt Ltd. |

GNG Electronics IPO Lot Size

The IPO allows retail investors to invest in a minimum and maximum of 1 Lot (63 Shares) amounting to Rs. 14931 and 13 Lots (819 Shares) amounting to Rs. 1,94,103, respectively, while for HNI investors, the minimum Lot is 14 (882 Shares) amounting to Rs. 2,09,034.

|

Minimum Lot Investment (Retail) |

1 Lot |

|

Maximum Lot Investment (Retail) |

13 Lots |

|

S-HNI (Minimum) |

14 Lots |

|

S-HNI (Maximum) |

66 Lots |

|

B-HNI (Minimum) |

67 Lots |

GNG Electronics IPO Reservation

|

Institutional Share Portion |

50% |

|

Retail Investors' Share Portion |

35% |

|

Non-Institutional Shares Portion |

15% |

Promoters And Management of Smartworks Coworking Ltd.

- Sharad Khandelwal.

- Vidhi Sharad Khandelwal.

- Amiable Electronics Private Limited.

- Kay Kay Overseas Corporation.

|

Pre-Issue Promoter Shareholding |

95.01% |

|

Post-Issue Promoter Shareholding |

- |

GNG Electronics IPO Lead Managers

-

Motilal Oswal Investment Advisors Limited.

Dividend Policy

The company has paid no dividends in the last three fiscal years.

Conclusion

Investing in GNG Electronics IPO gives an investor a chance in a refurbished ICT devices with good revenue growth and a broad international reach. Despite a concentration of customers and geopolitical risks of imports, the company remains promising owing to its advanced modern manufacturing capabilities and broader product lines.

DISCLAIMER: This is NOT any buy or sell recommendation. No investment or trading advice is given. The content is for informational purposes. Before making investment decisions, always get advice from your qualified financial advisor.

Finowings IPO Analysis

Hope you enjoyed the Finowings IPO Analysis. We tried our best to give every required detail about the company that you should know before applying to the IPO.

You must consult your financial advisor before making any financial decisions.

To Apply for the IPO, Click Here.

To Read the Prospectus of the Company Click Here to Download the DRHP.

Click Here To Stay Updated With The Upcoming IPOs.

DISCLAIMER: This blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

July 23, 2025.

July 30, 2025.

If you have applied for the IPO but have not been allotted the Shares by the Registrar and are now looking for “ what to do if the IPO refund is not received ”, then we have covered the blog, which explains the steps to get your IPO refund. Click the link to explore.

Rs. 225 to Rs. 237.