Home >> IPO >> Pushpa Jewellers IPO: GMP, Overview, And Price

Pushpa Jewellers IPO: GMP, Overview, And Price

Table of Contents

Pushpa Jewellers IPO- Complete Overview

Pushpa Jewellers IPO under the SME IPO category is a book build issue of Rs. 98.65 Cr by Pushpa Jewellers Limited. The company was founded in June 2009 as a manufacturer of lightweight 22kt designs intravenously assimilating Indian antique art with modern design practices.

The company offers Traditional and Modern Gold jewellery. Additionally, high-quality bangles, necklaces, rings, earrings, bracelets, pendants, mangal sutras, kadas, and even more are available under different categories.

Besides operating in several parts of India, it has also succeeded in exporting its products to Dubai and Australia, along with the United States.

Besides manufacturing facilities provided by the company, these cities also house three branches functioning as offices and showrooms of the company. These cities also house three branches functioning as showrooms and offices, which, along with manufacturing facilities provided by the company, constitute its gold jewellery stores in Hyderabad, Bangalore, and Chennai.

Pushpa Jewellers IPO Overview

The Pushpa Jewellers IPO date is on 30 June 2025, and its initial public offering will end on 02 July 2025.

The Rs. 98.65 crore new SME IPO comprises a combination of a fresh issue of 53.70 lac Shares (Rs. 78.94 Cr) and an offer for sale (OFS) of 13.41 lac Shares (Rs. 19.71 Cr). The Pushpa Jewellers IPO price is Rs. 143 to Rs. 147 for each Share.

The Pushpa Jewellers IPO listing date (expected) might be on Monday, Jul 07, 2025, and listing at the NSE and SME.

Click to open demat account and apply for the IPO.

Company Financial

(Amount in Cr)

|

Period |

31 Mar 2025 |

31 Mar 2024 |

31 Mar 2023 |

|

Total Assets |

91.10 |

51.46 |

43.39 |

|

Total Revenue |

281.27 |

255.49 |

165.84 |

|

PAT |

22.29 |

13.58 |

8.14 |

|

Net Worth |

58.14 |

36.08 |

22.50 |

|

Reserves & Surplus |

39.28 |

35.84 |

22.27 |

|

Borrowings |

21.93 |

8.26 |

14.79 |

Cash Flows

(Amount in lac)

|

Net Cash Flow in Multiple Activities |

31 Mar 2025 |

31 Mar 2024 |

31 Mar 2023 |

|

Net Cash Flow Operating Activities |

14.61 |

878.55 |

13.51 |

|

Net Cash Flow Investing Activities |

(1,008.07) |

42.70 |

(1,062.37) |

|

Net Cash Flow Financing Activities |

1,178.10 |

(723.24) |

1,035.86 |

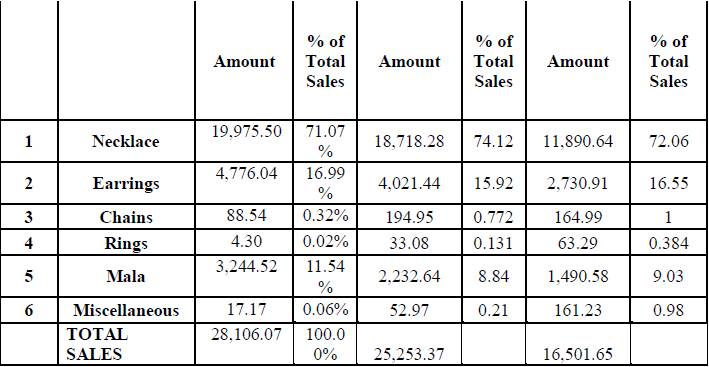

Revenue Bifurcation

Product-wise Revenue Breakdown

(Amount in lac)

Client-wise Revenue Breakdown

(Amount in lac)

State-wise Revenue Breakdown

(Amount in lac)

Sales-wise Revenue Breakdown

(Amount in lac)

(Source: RHP)

The Objective of the Issue

The company desires to use the Net Proceeds from the Issue to fulfill its following goals:

-

To cover working capital costs.

-

To finance the anticipated new showroom's establishment.

-

Capital investment cost for the new showroom that is being proposed.

-

Inventory costs for the planned new showroom.

-

Working capital requirements.

-

General corporate purposes.

Click to check the IPO application status.

Peers of Pushpa Jewellers Ltd.

|

Company Name |

Face Value (Rs.) |

EPS (Rs.) |

P/E (x) |

|

Sky Gold Ltd. |

10 |

56.13 |

5.52 |

|

Khazanchi Jewellers Ltd. |

10 |

18.15 |

30.98 |

Evaluation

The Pushpa Jewellers Limited IPO price is Rs. 143 to Rs. 147 for each Share.

Evaluation of P/E Ratio

Considering the FY ended on 31 Mar 2025 with an EPS of Rs. 11.82 from the last year, the resulting P/E ratio is 12.44x.

Considering the weighted EPS of Rs. 9.03 for the last three years, the P/E ratio is 16.27x.

Explore the Ace Alpha Tech IPO.

Comparative Analysis With Listed Peers

The average P/E Ratio of the industry is 109.53x.

|

Particulars |

P/E Ratio (x) |

|

Highest |

174.08 |

|

Lowest |

44.98 |

|

Average |

109.53 |

In simple words, the P/E ratio of this IPO is 12.44x, compared with the industry’s average P/E of 109.53x, indicating an undervaluation (on a P/E ratio basis only). Hence, the price of the Share seems fairly priced for the investors when considered based on the average P/E ratio of the industry.

IPO's Strengths

-

Innovative designs and a unique brand identity.

-

Insight into the promoters and the senior management team.

-

Optimal management of inventory systems.

-

Assurance of quality standards.

-

Systems for surveillance, safety, and security.

IPO’s Weaknesses

-

Exposed to changes in the cost of raw materials.

-

Unable to grow because of the handmade.

-

Reliance on economic downturns.

Pushpa Jewellers IPO GMP

Pushpa Jewellers IPO GMP is Rs. 0 as of 28 Jun 2025 at the time of writing this information. Hence, its estimated listing price might be Rs. 143 to Rs. 147.

IPO Timetable (Tentative)

The Pushpa IPO date of opening is from Jun 30 to Jul 02, 2025, allotment on Jul 03, refund initiation on Jul 04, and listing on Jul 07, 2025.

|

Events |

Date |

|

IPO Opening Date |

Jun 30, 2025 |

|

IPO Closing Date |

Jul 02, 2025 |

|

IPO Allotment Date |

Jul 03, 2025 |

|

Refund Initiation |

Jul 04, 2025 |

|

IPO Listing Date |

Jul 07, 2025 |

Pushpa Jewellers IPO Details

The IPO with a Face Value of Rs. 10 per share offers a total issue size of 67,11,000 Shares (Rs. 98.65 Cr) with a market maker portion of 3,36,000 Shares (Rs. 4.94 Cr).

|

IPO Opening & Closing Date |

30 Jun, 2025 to 02 Jul, 2025 |

|

Face Value |

Rs. 10 per Share |

|

Issue Price |

Rs. 143 to Rs. 147 per Share. |

|

Lot Size |

1000 Shares |

|

Issue Size |

67,11,000 Shares (Rs. 98.65 Cr) |

|

Offer for Sale |

13,41,000 Shares (Rs. 19.71 Cr) |

|

Fresh Issue |

50,34,000 Shares (Rs. 74 Cr) |

|

Listing at |

NSE, SME |

|

Issue Type |

Book Built Issue |

|

Registrar |

Cameo Corporate Services Limited |

IPO Lot Details

Retail investors can invest in a minimum and maximum of 1 Lot (1000 Shares) for Rs. 1,47,000 and in multiples thereof, while for HNI investors, the minimum Lot is 2 (2000 Shares) for Rs. 2,94,000.

|

Minimum Lot Investment (Retail) |

1 Lot |

|

Maximum Lot Investment (Retail) |

1 Lot |

|

HNI (Min) |

2 Lots |

IPO Reservation (% of Net Issue)

|

Institutional’s Portion |

47.49% |

|

Retail’s Portion |

33.24% |

|

Non-Institutional Portion |

14.26% |

Promoters And Management of Pushpa Jewellers Ltd

-

Mr. Mridul Tibrewal

-

Mr. Anupam Tibrewal

-

Mr. Madhur Tibrewal.

|

Pre-Issue Promoter Shareholding |

100% |

|

Post-Issue Promoter Shareholding |

- |

IPO Lead Managers

-

Affinity Global Capital Market Private Limited.

Dividend Policy

The company has not paid a dividend in the last three financial years.

Conclusion

Pushpa Jewellers IPO is set to debut in the market with an estimated Rs. 98.65 crore, which will showcase a mixture of traditional and modern jewellery pieces. They have experienced executives managing the company, strong financial metrics, and fair pricing compared to other industry players, which makes this IPO an option for investors looking to take part in India's growing jewellery sector. Besides, it has changes in cost changes and other risks.

Finowings IPO Analysis

Hope you enjoyed the Finowings IPO Analysis. We tried our best to give every required detail about the company that you should know before applying to the IPO.

You must consult your financial advisor before making any financial decisions.

To Apply for the IPO, Click Here.

To Read the Prospectus of the Company Click Here to Download the DRHP.

Click Here To Stay Updated With The Upcoming IPOs.

DISCLAIMER: This blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

June 30, 2025.

On July 07, 2025, this IPO can be listed.

To apply for this IPO, you need to have a demat account. If not, click to open demat account, then log in to the app and search for IPO, fill in the necessary details, bids, DOB, etc, during the IPO open date, and submit your request.

Its IPO price is Rs. 143 to Rs. 147.