Home >> Blog >> CoinDCX Review: Fees, Features, Safety & How It Works

CoinDCX Review: Fees, Features, Safety & How It Works

Table of Contents

- What Is CoinDCX?

- What the CoinDCX App is Capable Of

- Working of CoinDCX (Stepwise)

- Cryptocurrencies Available on CoinDCX

- Is CoinDCX Safe or Not?

- Good Things About CoinDCX

- CoinDCX vs Other Crypto Exchanges in India

- Who Should Use CoinDCX?

- Taxation on CoinDCX (India)

- Is CoinDCX Legal in India?

- Final Verdict: CoinDCX Review Summary

- Conclusion

- Key Takeaways

In the recent past, cryptocurrency investing in India has been exploding. With the increased interest, selecting a safe and reliable crypto exchange India is of the utmost importance. One of the most frequented sites in India is CoinDCX.

However, many investors continue to question:

Is CoinDCX safe?

What are CoinDCX fees?

How does the CoinDCX app function?

Is CoinDCX fit for novices?

In this CoinDCX review in its entirety, we will cover each variable one at a time, from features and fees through to safety and how the platform functions.

What Is CoinDCX?

CoinDCX is one of the best cryptocurrency exchanges in India. The Indian Rupee (INR) allows customers to use, sell and exchange cryptocurrencies. Since its inception in 2018, CoinDCX exchange India has cemented their status and is now a reputable provider to millions of customers in the country.

Overview of CoinDCX App.

-

Crypto accessibility for Indians.

-

Trade well-known cryptocurrency pairs.

-

Monitor current prices and charts.

-

Make investments with SIP-style choices.

-

Easily withdraw money to bank accounts.

The CoinDCX app is designed for both newbie and expert traders and is accessible on both Android and iOS.

What the CoinDCX App is Capable Of

-

Users can buy and sell crypto using INR.

-

Users are able to trade famous crypto pairs.

-

Users are able to view live prices and view and analyse charts.

-

Users can invest in crypto using the SIP (Systematic Investment Plan) method

-

Users are able to do easy and quick fund withdrawals to their bank accounts.

The app meets the performance and speed expectations of users and especially for first-time crypto investors, the ease of navigation will remove any hassle on their end.

Working of CoinDCX (Stepwise)

It is highly recommended for users to have a proper understanding of a platform in and out before they begin investing in it.

Step 1: Account Registration

Register using your email address or a phone number. Complete the KYC process using your PAN and Aadhaar.

Step 2: Add Funds

Use UPI, internet banking, or a wire transfer to deposit your money. When money is added to the wallet, it is available instantly.

Step 3: Buy or Trade Crypto

-

Select a cryptocurrency to trade.

-

Specify how much money or how many units you want.

-

You can either buy the asset instantly or set up more complex trades.

Step 4: Store or Withdraw

-

You can keep the cryptocurrency you purchase in your CoinDCX digital wallet.

-

If you want to use the money from your cryptocurrency, you can sell it and transfer the money to your bank.

-

This is one of the easiest platforms to trade cryptocurrency, which is why CoinDCX is one of the most preferred platforms in India.

Cryptocurrencies Available on CoinDCX

CoinDCX offers an incredibly large number of cryptocurrencies to trade. Some of the more popular ones include:

-

Bitcoin (BTC).

-

Ethereum (ETH).

-

Solana (SOL).

-

Polygon (MATIC).

-

Ripple (XRP).

-

Dogecoin (DOGE).

A lot of other newer alternative cryptocurrencies (altcoins). This large number of cryptocurrencies makes CoinDCX a very popular crypto exchange India.

CoinDCX Fees

Failing to set proper fees is extremely unattractive for many users, which is why most CoinDCX reviews have a fees section.

Trading Fees

Maker: 0.1%

Taker: 0.1%

Compared to other cryptocurrency exchanges in India, these fees are a lot more competitive.

Deposit Fees

Most banks will not charge you any fees to deposit money in your account via UPI or bank transfers.

Withdrawal Fees

You will have to pay some small fees to withdraw money from your account, due to your bank's policies. The fees to withdraw crypto depend on the fees associated with the blockchain. All in all, CoinDCX fees are consumer-friendly and have low fees overall.

Is CoinDCX Safe or Not?

Investors want to know if their investments are safe with CoinDCX. So, is CoinDCX safe or not?

CoinDCX Security Measures

Two-step verification.

A large portion of the crypto is kept in cold storage. Security audits are often conducted

High Security.

CoinDCX is the most secure crypto platform in India.

Regulatory Compliance

CoinDCX is compliant with the Indian KYC regulations. CoinDCX operates within India’s laws.

Every platform in the crypto space is risky to some degree. However, CoinDCX is one of the most secure crypto exchange India platforms.

CoinDCX Features Explained

Here are the main features that have contributed to the overall popularity of CoinDCX.

INR-Based Trading

CoinDCX allows you to trade in INR, making it easier than most other platforms.

CoinDCX Earn

You can participate in CoinDCX Earn and earn passive income on your crypto. CoinDCX allows you to earn interest on certain crypto holdings.

Long-term holders will appreciate this option.

SIP Style Crypto Investment

With investing options like SIPs, the CoinDCX app lets users invest small amounts continuously. This option aids beginners in investing with a high level of discipline.

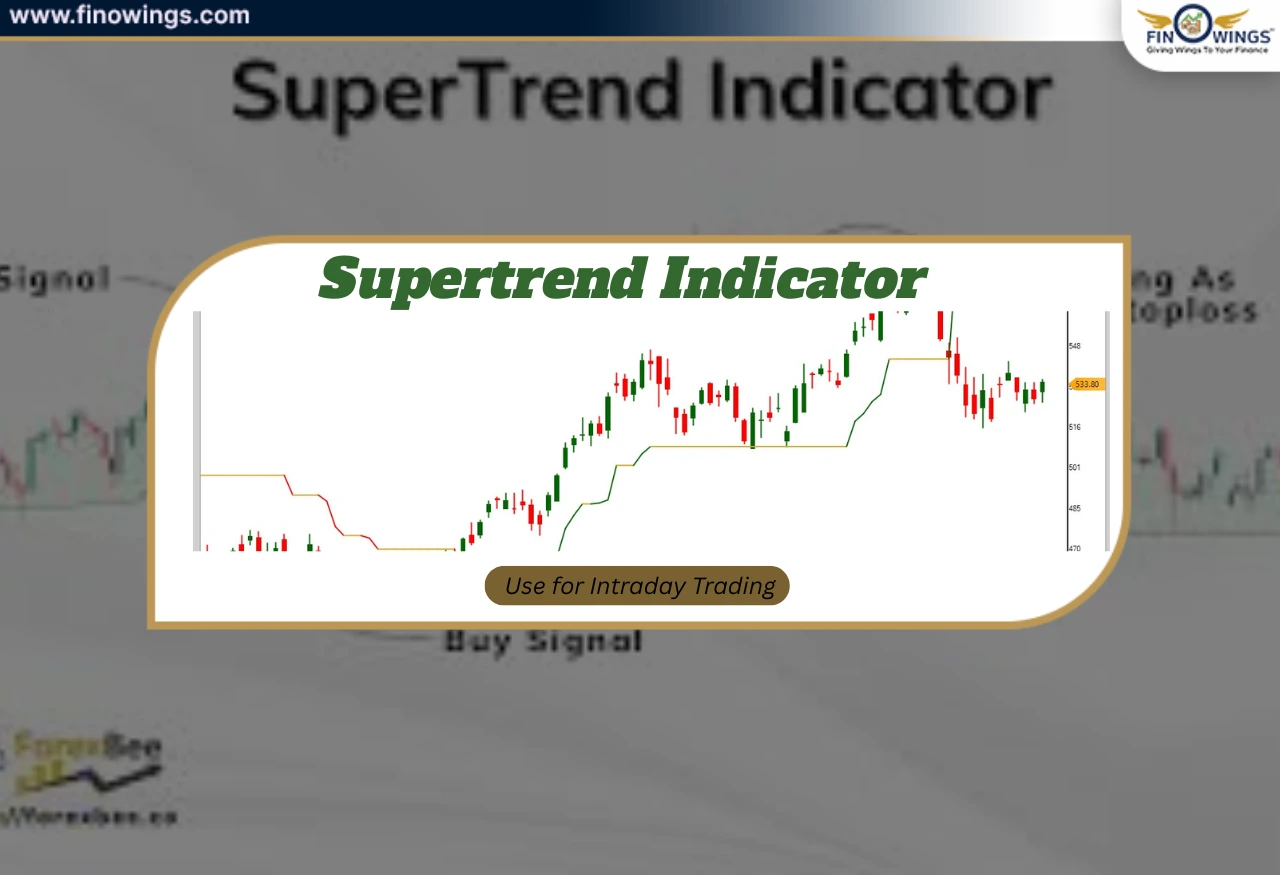

Advanced Trading Tools

Regardless of your experience, anyone can appreciate:

-

Real-time chart tracking.

-

Limit and market order capabilities.

-

High liquidity pairs.

-

Education and Learning.

CoinDCX has tailored educational materials for:

-

Novices

-

Risk management

-

The various components within crypto markets.

Having educational materials available is always a plus in any CoinDCX review.

Good Things About CoinDCX

Positives

-

Seamless INR deposits and withdrawals.

-

Intuitive mobile application.

-

A diverse selection of cryptocurrencies.

-

Reasonably priced trading fees.

-

Reliable safety features.

-

Good for new users and seasoned traders alike.

These factors contribute to why CoinDCX is a top option in the Indian exchanges.

Negatives

-

Crypto withdrawals can be slow at times.

-

Does not support several complex trading options.

-

It could enhance the speed at which you respond to inquiries.

-

Uncertain crypto regulations within India.

-

This information is important in knowing a decision that is right to make when investing.

CoinDCX vs Other Crypto Exchanges in India

|

Feature |

CoinDCX |

Other Indian Exchanges |

|

INR Support |

Yes |

Yes |

|

User Interface |

Simple |

Varies |

|

Fees |

Competitive |

Often higher |

|

Security |

Strong |

Depends |

|

Beginner Friendly |

Yes |

Not always |

This comparison shows why CoinDCX is often preferred by beginners.

Who Should Use CoinDCX?

CoinDCX is suitable for:

-

Beginners entering crypto

-

Long-term investors

-

SIP-based crypto investors

-

Traders looking for INR pairs.

It may not be ideal for:

-

High-frequency derivatives traders.

-

Users seeking global leverage products.

Taxation on CoinDCX (India)

Crypto taxation applies regardless of platform.

Key points:

-

30% tax on crypto profits.

-

1% TDS on transactions above threshold.

-

Losses cannot be offset.

-

CoinDCX provides transaction history to help with tax filing.

Common Mistakes to Avoid on CoinDCX

-

Investing without understanding volatility.

-

Trading emotionally.

-

Ignoring tax rules.

-

Storing large funds without personal wallets.

-

Over-trading due to easy app access.

-

Crypto investing requires discipline.

Is CoinDCX Legal in India?

This is the case at the moment:

-

Crypto trading is not illegal in India.

-

Regulations are evolving.

-

Platforms like CoinDCX operate legally with KYC.

-

Crypto is still not legal tender, so investors must keep an eye out for government legislation.

Final Verdict: CoinDCX Review Summary

After analysing everything, the findings are:

-

The CoinDCX app is user-friendly.

-

CoinDCX fees are reasonable.

-

Security structures are robust.

-

The platform is appropriate for Indians.

-

Good trade-off between simplicity and features.

For novices as well as those investing for the long haul, CoinDCX is a trustworthy crypto exchange in India.

Conclusion

This detailed review of CoinDCX indicates that CoinDCX is today one of the most user-friendly and trusted crypto platforms in India. It simplifies access to crypto investing with its straightforward access to INR, security features and fee structure.

It should be noted that the cryptocurrency markets are volatile and so are the legislation and other threats, which should be put to the fore. Always invest sensibly and invest in the things that you can afford to lose.

Key Takeaways

If you need a user-friendly, INR-based and comparatively secure crypto exchange, it is CoinDCX exchange in India. Effective educational and risk management strategies must accompany the use of the platform.

DISCLAIMER: This blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

Yes, CoinDCX uses two-factor authentication, cold storage for funds, regular security audits, and follows KYC norms, making it one of the safer crypto exchanges in India.

CoinDCX charges around 0.1% maker and taker fees per trade, which is considered competitive among Indian crypto exchanges.

Crypto trading is not illegal in India. CoinDCX operates legally as an exchange with KYC compliance, though crypto is not recognized as legal tender.

Yes, CoinDCX is beginner-friendly with a simple interface, INR deposits, SIP-style investing, and educational resources for new users.

You can sell your crypto to INR and withdraw funds directly to your linked bank account using the CoinDCX app, usually processed within a few hours to a day.