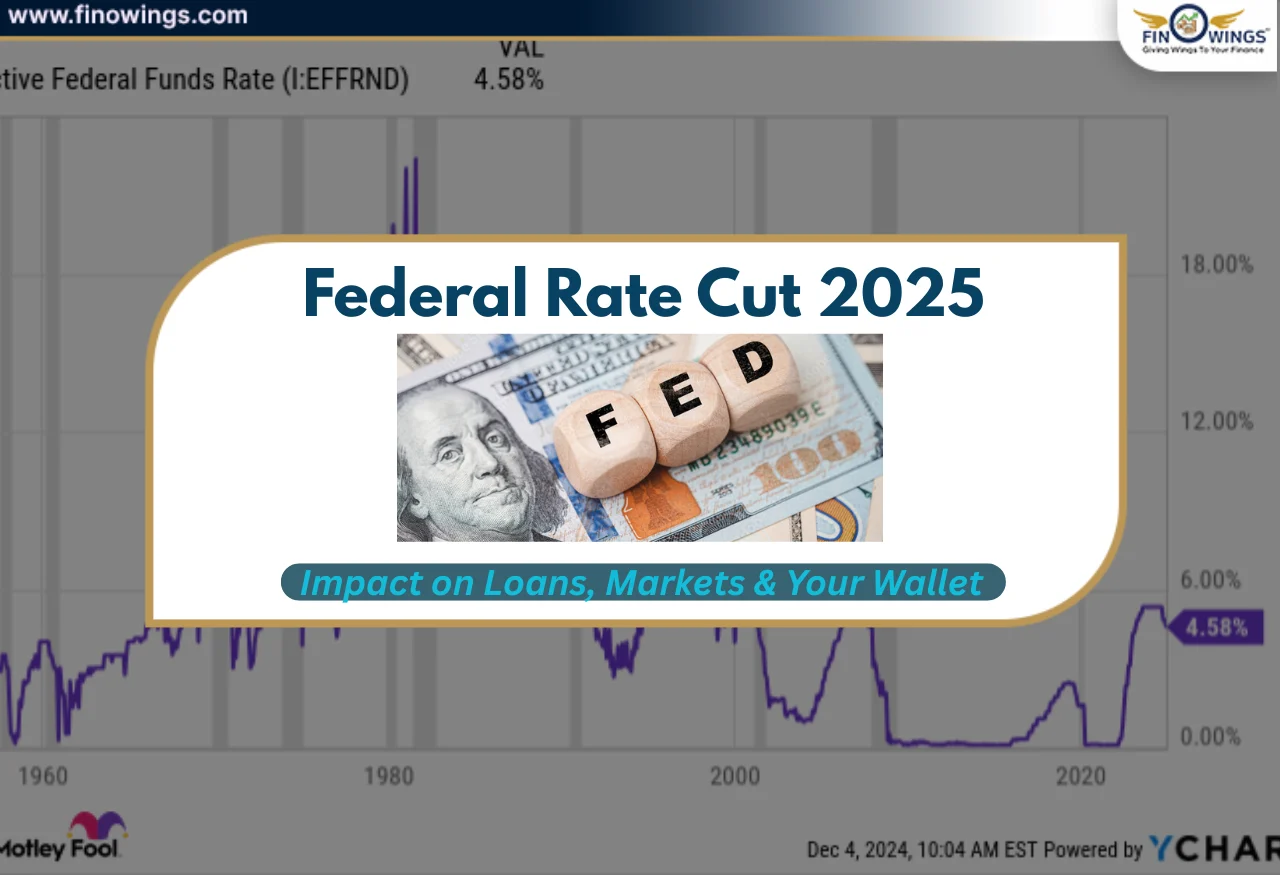

Home >> Blog >> Federal Rate Cut 2025: Impact on Loans, Markets & Your Wallet

Federal Rate Cut 2025: Impact on Loans, Markets & Your Wallet

Table of Contents

- What does Federal Rate Cut 2025 mean?

- Why Did the Fed Cut Interest Rates in 2025?

- How the Market Performed After the Rate Cut

- Loan EMI Impact: Will EMIs Become Cheaper?

- Impact on Your Wallet: Everyday Financial Effects

- What Will Happen to the Indian Economy

- Market Strategy for 2025: Is it a good time to invest?

- Impact on Businesses

- Global Impact other than India

- Increase Your Investing Caution While Staying Positive

- Conclusion

On December 10, 2025, the Fed made the decision to lower interest rates by 25 basis points to the range of 3.50% to 3.75% due to the high pace of inflation in the US economy and the deteriorating job market.

What does rate decrease news really mean for you? In what ways does this news affect the debt you're obligated to pay, general market shifts, inflation, and the growth of the economy in the world?

What does Federal Rate Cut 2025 mean?

When the Fed wants to cut rates, it wants to:

• stimulate the economy

• make it easier to borrow

• increase the amount of money in the economy, and

• relieve the economy of recession/pressure.

In the Federal Rate Cut 2025, the Fed's cut is aimed at the balance of economic activity and the stabilization of financial conditions.

What happens after the Fed cuts is that the world feels the aftershocks right from Wall Street to Dalal Street and from a family's mortgage to all the way around corporate Canada, and this includes all expense cuts.

Why Did the Fed Cut Interest Rates in 2025?

In this section, let's break down the interest rate cut:

-

Declining consumer spending, spending, and hiring - Weakening consumer spending, manufacturing and eating showed signs of the U.S. economy cooling.

-

Improvements in inflation - It allowed the Fed to cut rates economically without inflationary pressures.

-

Liquidity disruptions - The Fed’s hand was forced sooner because of the series from the start of 2025.

-

Rate reduction to protect the global economy - The strong dollar cycles were putting pressure on the Emerging markets. It resulted in the Federal Rate Cut 2025 decision.

How the Market Performed After the Rate Cut

The markets across the globe's reaction was sharp and mixed.

U.S Stock Market

Improved liquidity and lowered borrowing expectancy jump.

Indian Stock Market

At the start showed positive momentum, particularly in:

- Rate-sensitive sectors (banks, NBFCs), real estate

- Auto stocks

As global risk was reassessed by the investors, they experienced volatility later on.

Dollar Index

Emerging markets (like India) benefit from a rate cut and typically weaken after it.

Gold Prices

Gold prices typically increase as interest rates decline because investors prefer ‘safe’ gold over assets.

Bond Yields

Declines in the 10-year bond yield increase the attractiveness of holding a larger stock of a bond and increase the prices of the bond. The combination of the above reflects a shift in global fear.

Loan EMI Impact: Will EMIs Become Cheaper?

Many people immediately search:

“If the Federal cuts rates, will my EMI be cut?”

The answer is YES - indirectly. While the Federal cut does not directly impact the rate of loans in India, it does reduce the pressure of global interest, providing the RBI a chance of cutting rates in India.

Home Loans

There is a potential for a cut in EMIs for home loans if there is a reduction in interest rates aimed at decreasing EMIs.

Car Loans

Demand for auto loans is expected to increase as interest rates decline.

Personal Loans

It is expected that interest rates will decrease as liquidity for banks becomes cheaper, thus causing cheaper personal loans.

Businesses & MSME loans

The reduction of interest rates is expected to improve the affordability of loans, resulting in an increase in investment activity.

For this reason, the loan EMI impact of the federal rate cut 2025is not immediate; however, it increases the chance of the RBI lowering the repo rates at the end of the year.

Impact on Your Wallet: Everyday Financial Effects

Cheaper Borrowing

There is an expectation that money will be cheaper to borrow.

More Investor Choices

When interest rates go down, it’s a good time to invest in the stock market, and it can increase the returns on your investments.

Fixed Deposit (FD) Rates Might Decrease

FD rates are also likely to decrease to align with the lower interest rates.

Increased Strength of the Rupee

When the dollar is weaker, it helps the rupee get stronger, and it helps decrease the costs of imports like electronics and fuel.

Decreased Inflationary Pressures

Lower interest rates relieve the pressures on businesses, and because of that, they are able to control the rate of inflation. Ultimately, a decrease in interest rates facilitates more spending from businesses and households, but at the same time, it also takes away options for guaranteed returns on your investments.

Federal Rate Cut 2025 Winners and Losers

Winners

- High-growth technology companies.

- Equity Investors.

- Banking and Finance.

- Auto Industry.

- Real Estate Companies.

Losers

- Fixed Deposit Investors.

- Longer-Term Bond Investors (Only short-term gains).

- Exporters of the Dollar.

Ultimately, the location of your investments determines your profits and your losses.

What Will Happen to the Indian Economy

A lower interest rate in 2025 will have a big impact on India.

More FII Investments

Lower interest rates in the U.S. lead to more foreign investments in India.

More Corporate Profits

Lowered costs of capital increase profit margins.

More FII Investments

Lower interest rates in the U.S. lead to more foreign investments in India.

More Corporate Profits

-

Lowered costs of capital increase profit margins and corporate profits.

-

Reduced costs for new businesses & Tech.

-

When there is a global recession, venture funding is abundant.

Improved market conditions

The stocks, property and cyclical markets do well. This is why there is a lot of focus on news of rate cuts and on the centres of the global banks.

Forecast for inflation of the year 2025: What do we expect?

There is a strong correlation between the decision of the Fed and the expectations of inflation around the world.

Declining inflation

-

The prices of basic commodities around the world are stabilising.

-

The shipping industry is stabilising.

-

There are no more supply chain issues that the pandemic caused.

-

RBI is likely to be cautious

-

If inflation keeps being low, the RBI will likely do its own rate cuts in 2025.

-

If inflation is stable, the outlook for it will help people spend more money and help the economy grow.

Market Strategy for 2025: Is it a good time to invest?

This is what wise investors are doing.

Increasing the Diversification of Portfolios

Diverse assets such as funds, shares, and bonds.

Investment in rate-sensitive sectors

Banking, NBFCs, real estate, and the automobile industry.

Investment in top-grade bonds

The prices of bonds go up as the yields go down, so it is wise to invest in bonds.

No Investment in risky small-caps.

There are likely to be many unexpected market conditions and small-cap investments are likely to be of very low value.

More stable investments during market adjustment

There is likely to be a lot of unexpected movements in the market as it adjusts to volatile global conditions.

SIP Continuation

Systematic investing capitalises on corrections during downturns and recoveries during upswings. Winning traders perceive every market reaction as a chance to seize an advantage.

Impact on Businesses

-

Reduced borrowing costs

-

Corporations are able to restructure loans and expect to pay less.

-

Increased operational costs

-

Businesses are likely to grow, recruit more personnel, and build additional offices.

-

Enhanced liquidity

-

Roughly, cash working capital pressures are relieved, improving net profit margins.

-

Benefits of exports

-

Weakening dollar affects more Indian exports and diminishes costs.

Global Impact other than India

-

Gains in the emerging market

-

Lower US rates bring down capital flows without.

-

Benefit from commodity exporters

-

Demand for commodities increases with lower rates.

-

Higher liquidity in a lower-rate economy often sees the cryptocurrency market rally.

-

Many will follow the Fed in cutting rates, which will also support the economy.

-

This is why the Federal Rate Cut 2025 is seen to have a very strong global impact.

Increase Your Investing Caution While Staying Positive

The upcoming outlook for the economy is positive, but there are still risks to consider, including:

1. The stock market is, and always will be, volatile.

2. There will be no Fed policy that is certain.

3. There is the potential for inflation to return.

4. There will always be currency risks involved.

5. Global trade will always be subject to trade and currency risks.

Investing caution will always be warranted. Caution has always worked best when approached with optimism.

Conclusion

Borrowing will be easier with the Federal Reserve Rate Cut for 2025. Global market liquidity will be improved and positive. News on the rate cut shows a positive trend for businesses and households. New market opportunities are also likely with the stable inflation outlook. Investors need to be aware and prepared to seek new opportunities. There are a lot of positive opportunities available in the market but also many global threats that need to be considered.

DISCLAIMER: This blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

The Federal Reserve cut rates in 2025 due to weakening consumer spending, cooling inflation, liquidity disruptions, and global economic pressure from a strong dollar. The cut was intended to stabilize financial conditions.

Rate cuts in the U.S. do not directly reduce EMIs in India, but they increase the chances of RBI cutting rates later. This can gradually reduce EMIs for home, car, personal, and MSME loans.

Indian markets initially saw positive momentum in rate-sensitive sectors like banking, NBFCs, real estate, and auto. However, global volatility and investor risk assessment created fluctuations afterward.

Yes, indirectly. Lower interest rates ease borrowing costs, reduce pressure on businesses, and often stabilize prices globally. With improved liquidity, inflation expectations soften.

India may see higher FII inflows, increased corporate profits, reduced borrowing costs, stronger liquidity, and better conditions for new businesses and tech sectors. It also supports growth in property, stocks, and cyclical sectors.

.webp)