Home >> Blog >> Stock Market Crash: 5 Biggest Reason

Stock Market Crash: 5 Biggest Reason

Table of Contents

Stock market today: Sensex fell by 3%

On Monday, August 5, 2024, the Indian stock market took a big hit with both Sensex and Nifty 50 dropping almost 3% each. The decline reflects a larger global trend that has been caused by several negative factors. Let’s take a look at some of the main reasons for this market crash.

Market Performance Overview

In the session, Sensex fell by 3.3%. Likewise, Nifty 50 declined by 2.68%. BSE Midcap index dropped down by 3.60% while the Smallcap index plunged further to -4.21%. Overall, BSE-listed firms’ market capitalization dropped from ₹457 lakh crore to about ₹442 lakh crore or nearly ₹15 lakh crore less in total value.

Key Factors Behind the Decline

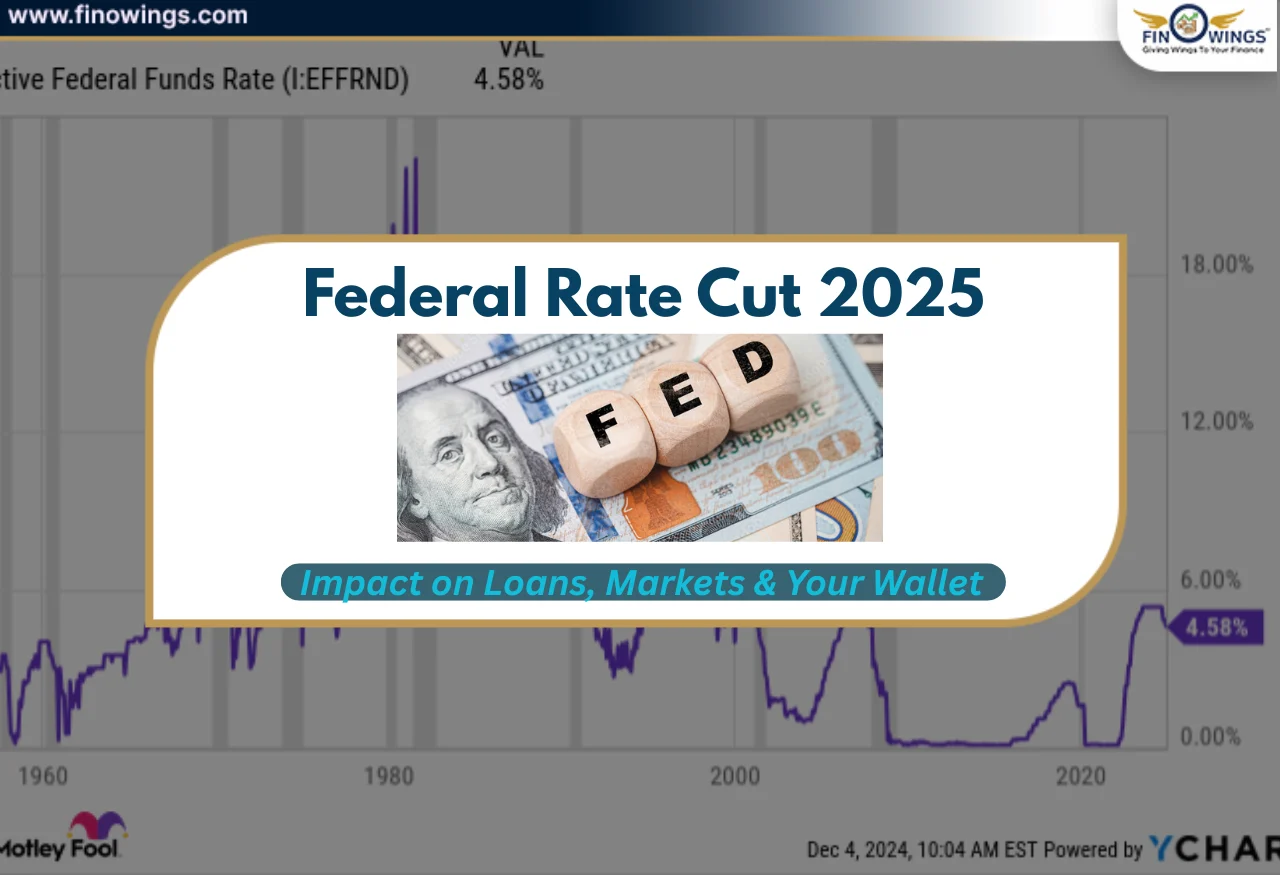

1- Concerns over US Recession

Global investor sentiment was affected due to fears of an impending recession in America where recent job data showed that US unemployment rose to 4.3% in July which marked four consecutive months increasing steadily reaching its highest level since almost three years now making investors jittery leading them towards selling off worldwide.

2- Rising Middle East Tensions

Geopolitical tensions have risen after Israel killed Hamas political chief Ismail Haniyeh during his visit to Iran who vowed retaliation raising fears of possible war as US military presence increases adding more uncertainty around this region and making every other investor nervous all around thus contributing towards such declines seen here within markets globally.

Detailed Video:

3- Stretched Valuations

Indian stock markets are trading at high valuations particularly among mid-cap & small-cap segments under pressure from corrective action across these sectors following bull run periods when buying on dips worked well but it may not be effective anymore so be careful during this correction phase if you’re an investor. Overvalued sectors like defense and railways are likely to see significant declines.

4- Unimpressive Q1 Results

The financial performance of Indian companies for the June quarter (Q1FY25) was mixed and did not boost market sentiments even though earnings growth supported the previous rally experts predict a slowdown across many sectors which led to profit booking further dragging down indices towards lower levels again.

5- Technical Factors: Nifty50 Below 20-DMA

Technically speaking though, Nifty's drop below its twenty-day moving average indicates weak sentiment prevailing within broader markets where analysts suggest that bounce back could happen once Nifty closes above twenty-four thousand four hundred levels otherwise, deeper cuts might follow if it settles below the twenty-four thousand mark closing basis.

Conclusion

Several factors can be attributed to the drastic fall of the Indian stock market on August 5, 2024. Global recession fears, geopolitical tensions, overvaluation, lackluster corporate earnings, and negative technical indicators all contributed to this. In such a turbulent environment where investors should be wary and not rush into any decisions at all will seek to navigate through global markets that face these challenges by carefully watching economic indicators as well as developments in geopolitics which are important for handling uncertain times ahead.

Disclaimer: This Stock Analysis is only for informational purposes and should not be considered as investment advice. Always do your research and consult with a financial advisor.

Author

Frequently Asked Questions

The Indian stock market fell today primarily due to concerns over a potential US recession, rising geopolitical tensions in the Middle East, stretched valuations in mid-cap and small-cap stocks, unimpressive Q1 financial results from Indian companies, and negative technical indicators with Nifty 50 dropping below its 20-day moving average.

Today, the Sensex fell by 3.3% and the Nifty 50 declined by 2.68%.

The market capitalization of BSE-listed firms dropped from ₹457 lakh crore to about ₹442 lakh crore, resulting in a loss of nearly ₹15 lakh crore in total value.

The BSE Midcap index dropped by 3.60%, while the Smallcap index plunged further by 4.21%.

Global investors are worried about a US recession because recent job data showed that US unemployment rose to 4.3% in July, marking four consecutive months of increases and reaching its highest level in nearly three years.

.webp)