Home >> IPO >> Meta Infotech IPO: GMP, Overview, And Price

Meta Infotech IPO: GMP, Overview, And Price

Table of Contents

Meta Infotech IPO- Complete Overview

Meta Infotech IPO under the SME IPO category is a book build issue of Rs. 80.18 Cr by Meta Infotech Limited. The company was founded in 1998 and is offering solutions for the cybersecurity infrastructure of diverse sectors such as banking, IT, and manufacturing.

The company provides consulting services with a focus on information and systems security as well as sustainment services to protect these technologies.

They are authorised resellers of cybersecurity products from international OEMs and provide solutions for secure access as well as protected access for cloud workloads.

Meta Infotech offers complete cybersecurity solutions to clients in banking, IT, insurance, and manufacturing industries. The company streamlines digital asset utilisation by managing network resource optimisation and guaranteeing dependable and scalable connectivity for managed digital infrastructures.

Meta Infotech IPO Overview

The Meta Infotech IPO date is on 04 July 2025, and its initial public offering will end on 08 July 2025.

The Rs. 80.18 crore new SME IPO comprises a combination of a fresh issue of 12.45 lac Shares (Rs. 20.04 Cr) and an offer for sale (OFS) of 37.35 lac Shares (Rs. 60.13 Cr). The Meta Infotech IPO price is Rs. 153 to Rs. 161 for each Share.

The Meta Infotech IPO listing date (expected) might be on Friday, Jul 11, 2025, and listing at the BSE and SME.

Click to open demat account and apply for the IPO.

Company Financial

(Amount in Cr)

|

Period |

31 Mar 2025 |

31 Mar 2024 |

31 Mar 2023 |

|

Total Assets |

74.38 |

59.03 |

76.41 |

|

Total Revenue |

220.02 |

153.05 |

109.54 |

|

PAT |

14.50 |

10.51 |

6.54 |

|

Net Worth |

44.55 |

30.05 |

19.54 |

|

Reserves & Surplus |

26.91 |

29.28 |

18.77 |

|

Borrowings |

17.35 |

0.77 |

7.60 |

Cash Flows

(Amount in lac)

|

Net Cash Flow in Multiple Activities |

31 Mar 2025 |

31 Mar 2024 |

31 Mar 2023 |

|

Net Cash Flow Operating Activities |

(1,273.76) |

(377.35) |

3,450.12 |

|

Net Cash Flow Investing Activities |

(797.17) |

1,063.59 |

(1,862.80) |

|

Net Cash Flow Financing Activities |

1,550.73 |

(815.78) |

(919.51) |

Revenue Bifurcation

Industry-wise Revenue Breakdown

(Amount in lac)

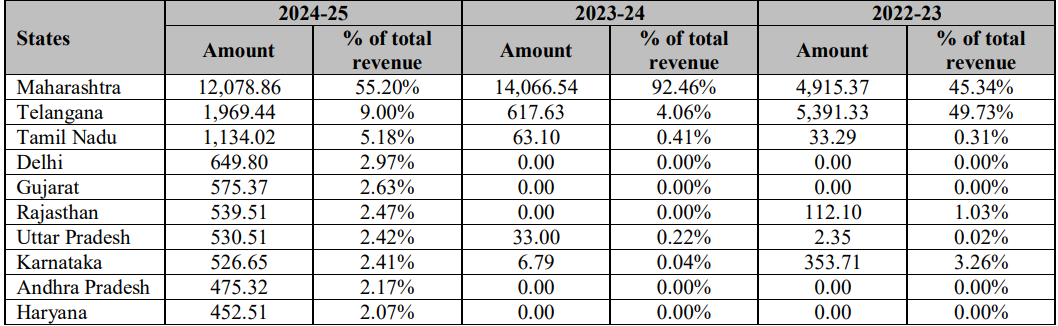

State-wise Revenue Bifurcation

(Source: RHP)

The Objective of the Issue

The company desires to use the Net Proceeds from the Issue to fulfill its following goals:

-

Repayment of some of the remaining debts, either in full or in part.

-

Financing the construction of new office space at Unit No. 911, 9th Floor, MINT Sahar, Andheri-Kurla Road, Andheri East, Mumbai.

-

Establishment of an interactive experience center at our registered office, located at Units 118 and 119, First Floor, Ackruti Star, MIDC, Andheri East, Mumbai 400093.

-

General corporate purposes.

Click to check the IPO application status.

Listed Peers of Meta Infotech Ltd.

|

Company Name |

Face Value (Rs.) |

EPS (Rs.) |

P/E (x) |

|

Tac Infosec Limited |

10 |

13.77 |

76.35 |

|

Quick Heal Technologies Ltd. |

10 |

0.94 |

391.32 |

|

Sattrix Information Security Ltd. |

10 |

6.27 |

33.17 |

Evaluation

The Meta Infotech Limited IPO price is Rs. 153 to Rs. 161 for each Share.

Evaluation of P/E Ratio

Considering the FY ended on 31 Mar 2025 with an EPS of Rs. 8.22 from the last year, the resulting P/E ratio is 19.58x.

Considering the weighted EPS of Rs. 6.72 for the last three years, the P/E ratio is 23.95x.

Explore the Cryogenic OGS IPO.

Comparative Analysis With Listed Peers

The average P/E Ratio of the industry is 166.95x.

|

Particulars |

P/E Ratio (x) |

|

Highest |

391.32 |

|

Lowest |

33.17 |

|

Average |

166.95 |

In simple words, the P/E ratio of this IPO is 19.58x, compared with the industry’s average P/E of 166.95x, indicating an undervaluation (on a P/E ratio basis only). Hence, the price of the Share seems fairly priced for the investors when considered based on the average P/E ratio of the industry.

IPO's Strengths

-

One integrated centre for protecting digital assets and the supporting technology.

-

Seasoned leadership backed by a skilled and certified workforce.

-

A dependable partner for many years to a distinguished clientele.

-

Forged alliances with top producers of cybersecurity equipment.

IPO’s Weaknesses

-

During fiscal year 2025, imported products and licences contributed 86.19% to Meta Infotech's total sales, with the bulk arriving from the United States and Singapore. As a result, any new trade barriers, regional tensions could raise costs.

-

Multiple companies within the promoter group, Meta Infotech Australia Pvt Ltd and Meta Infotech-Dubai, among them, also target the same market segment. Such overlap creates the risk of internal competition.

-

By April 30, 2025, more than Rs. 52,700 lac, or roughly 92% of the firm's Rs. 57,313 lac backlog, is linked to a single banking institution. A breakdown in this partnership or delays in service rollout would therefore pose a serious threat to revenue streams and overall financial health.

Meta Infotech IPO GMP

Meta Infotech IPO GMP is Rs. 0 as of 01 Jul 2025 at the time of writing this information..

IPO Timetable (Tentative)

The Meta IPO date of opening is from Jul 04 to Jul 08, 2025, allotment on Jul 09, refund initiation on Jul 10, and listing on Jul 11, 2025.

|

Events |

Date |

|

IPO Opening Date |

Jul 04, 2025 |

|

IPO Closing Date |

Jul 08, 2025 |

|

IPO Allotment Date |

Jul 09, 2025 |

|

Refund Initiation |

Jul 10, 2025 |

|

IPO Listing Date |

Jul 11, 2025 |

Meta Infotech IPO Details

The IPO with a Face Value of Rs. 10 per share offers a total issue size of 49,80,000 Shares (Rs. 80.18 Cr) with a market maker portion of 2,52,000 Shares (Rs. 4.06 Cr).

|

IPO Opening & Closing Date |

04 Jul, 2025 to 08 Jul, 2025 |

|

Face Value |

Rs. 10 per Share |

|

Issue Price |

Rs. 153 to Rs. 161 per Share. |

|

Lot Size |

800 Shares |

|

Issue Size |

49,80,000 Shares (Rs. 80.18 Cr) |

|

Offer for Sale |

37,35,000 Shares (Rs. 60.13 Cr) |

|

Fresh Issue |

9,93,000 Shares (Rs. 15.99 Cr) |

|

Listing at |

BSE, SME |

|

Issue Type |

Book Built Issue |

|

Registrar |

Kfin Technologies Limited |

IPO Lot Details

Retail investors can invest in a minimum and maximum of 1 Lot (800 Shares) for Rs. 1,28,800 and in multiples thereof, while for HNI investors, the minimum Lot is 2 (1600 Shares) for Rs. 2,57,600.

|

Minimum Lot Investment (Retail) |

1 Lot |

|

Maximum Lot Investment (Retail) |

1 Lot |

|

HNI (Min) |

2 Lots |

IPO Reservation (% of Net Issue)

|

Institutional’s Portion |

47.42% |

|

Retail’s Portion |

33.22% |

|

Non-Institutional Portion |

14.25% |

Promoters And Management of Meta Infotech Ltd.

-

Venu Gopal Peruri.

|

Pre-Issue Promoter Shareholding |

94.94% |

|

Post-Issue Promoter Shareholding |

68.90% |

IPO Lead Managers

-

Hem Securities Limited.

Dividend Policy

The company has not declared dividends in the last three fiscal years.

Conclusion

Meta Infotech IPO is thrown into the rapidly expanding cybersecurity market, ensuring steady revenue growth with an attractive price-earnings ratio. Financial stability stems from a highly diversified customer-oriented portfolio, OEM major partnerships, and engagements across multiple sectors.

Finowings IPO Analysis

Hope you enjoyed the Finowings IPO Analysis. We tried our best to give every required detail about the company that you should know before applying to the IPO.

You must consult your financial advisor before making any financial decisions.

To Apply for the IPO, Click Here.

To Read the Prospectus of the Company Click Here to Download the DRHP.

Click Here To Stay Updated With The Upcoming IPOs.

DISCLAIMER: This blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

Jul 04, 2025.

On July 11, 2025, this IPO can be listed.

To apply for this IPO, you need to have a demat account. If not, click to open demat account, then log in to the app and search for IPO, fill in the necessary details, bids, DOB, etc, during the IPO open date, and submit your request.

Its IPO price is Rs. 153 to Rs. 161.

.webp)