Home >> IPO >> Prostarm Info Systems IPO: Price, Allotment, And GMP

Prostarm Info Systems IPO: Price, Allotment, And GMP

Table of Contents

- Prostarm Info Systems IPO - Complete Overview

- Prostarm Info Systems IPO Details

- Company Financial

- The Objective of the Issue

- Peers of Prostarm Info Systems

- Evaluation

- IPO's Strengths

- IPO’s Weaknesses

- Prostarm Info Systems IPO GMP Today

- Promoters and Management of Prostarm Info Systems Ltd.

- IPO Lead Managers

- Dividend Policy

- Conclusion

Prostarm Info Systems IPO - Complete Overview

Prostarm Info Systems IPO, a Mainboard IPO, is a book-built issue of Rs. 168 Cr (1.60 Cr Shares). Prostarm Info Systems Limited was incorporated in 2008 and is an Indian company that is involved in designing, manufacturing, and selling Energy Storage and Power Conditioning Equipment called Power Solution Products.

The company develops Power Solutions Products, ranging from UPS systems/inverter systems/solar hybrid inverter systems/lithium-ion battery packs/voltage stabilisers.

The branded as well as the mass-produced products are made in-house and outsourced to contract manufacturers. They also sell third-party batteries and third-party reverse logistics for UPS systems, batteries, and other associated products. The company also executes rooftop solar power plant projects in India in an EPC mode.

It provides services like installation, rental, and post-sales services like Warranty, post-warranty maintenance support, and expiry of Annual Maintenance Contract (AMC), which helps to increase the life of the products for multiple customers with varied applications.

It caters to a wide industry basket of healthcare, aviation, research, BFSI departments, railways, defence and security, education, and many other verticals with renewable energy, IT & Oil & Gas.

Clientele Base: It includes the Airports Authority of India, C.P.W.D, Bihar, Public Works Department, New Delhi, West Bengal Public Health Engineering Department, West Bengal Electronic Industry Development Corporation Limited, Telangana State Technology Services Limited, Railtel Corporation of India Limited, NTPC Vidyut Vyapar, and Nigam Limited.

As of 17 May 2025, its operations are through 21 branches and 2 depots located across 18 states & union territories.

This new IPO is to be launched on 27 May 2025, and its ‘initial public offering’ will end on 29 May 2025.

Prostarm Info Systems IPO Details

This Mainline IPO comprises a wholly fresh issue of 1,60,00,000 Shares (Rs. 168 Cr). The Prostarm Info Systems IPO listing date is June 03, 2025. The Prostarm Info Systems IPO price is between Rs. 95 to Rs. 105 for each Share.

If you want to apply for the IPO, click to open a Demat Account.

Company Financial

(Amount in Cr)

|

Period |

31 Dec 2024 |

31 Mar 2024 |

31 Mar 2023 |

|

Total Assets |

230.04 |

203.05 |

155.39 |

|

Total Revenue |

270.27 |

259.23 |

232.35 |

|

PAT |

22.11 |

22.80 |

19.35 |

|

Net Worth |

107.24 |

84.30 |

61 |

|

Reserves & Surplus |

64.37 |

41.42 |

18.13 |

|

Borrowings |

60.37 |

43.47 |

24.85 |

Cash Flows

The cash flows for various activities are shown below:

(Amount in lac)

|

Net Cash Flow In Multiple Activities |

31 Dec 2024 |

31 Mar 2024 |

31 Mar 2023 |

|

Net Cash Flow Operating Activities |

(1,053.45) |

(780.18) |

(1,350.31) |

|

Net Cash Flow Investing Activities |

(178.51) |

(785.82) |

(834.80) |

|

Net Cash Flow Financing Activities |

1,329.97 |

1,542.26 |

2,062.82 |

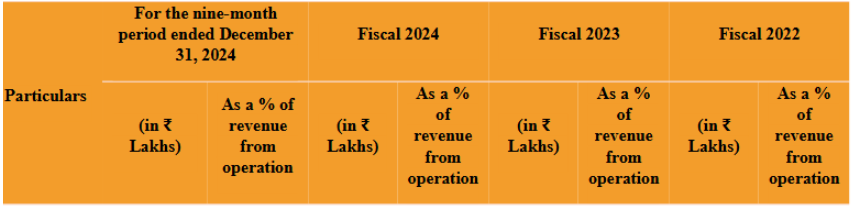

Geography-wise Revenue Bifurcation

Verticals-wise Revenue Bifurcation

Products-wise Revenue Bifurcation

Industry-wise Revenue Bifurcation

(Source RHP)

The Objective of the Issue

-

Financing the company's operating capital needs.

-

Repayment in full or in part of some outstanding loans that the company has taken out.

-

Using undisclosed acquisitions, other strategic efforts, and general corporate goals to achieve inorganic growth.

Peers of Prostarm Info Systems

|

Company Name |

Face Value (Rs.) |

EPS (Rs.) |

P/E (x) |

|

Servotech Power Systems Limited |

1 |

0.54 |

243 |

|

Sungarner Energies Limited |

10 |

5.22 |

55 |

Evaluation

The Prostarm Info Systems Limited IPO price is Rs. 95 to Rs. 105 for each Share.

Evaluation of P/E Ratio

Considering the FY ended 31 Dec 2024 with an EPS of Rs. 5.44 from the last year, the resulting P/E ratio is 19.30x.

Considering the weighted EPS of Rs. 4.72 for the last three years, the P/E ratio is 22.24x.

The Leela Hotels IPO application window is set to open on 26 May 2025.

Comparative Analysis With Listed Peers

The average P/E Ratio of the industry is 149.

|

Particulars |

P/E Ratio (x) |

|

Highest |

243 |

|

Lowest |

55 |

|

Average |

149 |

In simple words, the P/E ratio of this IPO (19.30x), compared with the industry’s average P/E of 149x, has an undervaluation (on a P/E ratio basis only). Hence, the price of the Share seems fairly priced for the investors when considered based on the average P/E ratio of the industry.

IPO's Strengths

-

Adapt the product and service to cater to various industries

-

Established business relationships with customers and a huge customer base.

-

Spatial distribution and distribution network.

-

Strong balance sheet position with a consistently solid track record of financial performance.

-

Proven Promoters and a dedicated management team.

IPO’s Weaknesses

-

Prostarm is capital-intensive as a business, with a significant proportion of the funds held as receivables and inventories, hence impacting short-term liquidity daily.

-

The company was seen to have negative cash flows from operations, investments, and financing activities. It means it had to take a loan or infuse capital.

-

All manufacturing units are situated in Maharashtra. Any regional-specific impact from political situations such as war, natural disaster or local issues could impact both operations and/or cash flows

Prostarm Info Systems IPO GMP Today

Prostarm Info Systems IPO GMP is Rs. 0 as of May 24, 2025, when this information was written. With the price of Rs. 105, the Prostarm Info Systems IPO listing price might be Rs. 105 (estimated).

Prostarm Info Systems Limited IPO Timetable (Tentative)

The Prostarm Info IPO dates are between May 27 to May 29. With IPO allocation on May 30, refund initiation on Jun 02, and listing on Jun 03, 2025.

|

Events |

Date |

|

IPO Opening Date |

27 May 2025 |

|

IPO Closing Date |

29 May 2025 |

|

IPO Allotment Date |

30 May 2025 |

|

Refund Initiation |

02 Jun 2025 |

|

IPO Listing Date |

03 Jun 2025 |

IPO Other Details

The IPO with a face value of Rs. 10 per Share, offers an IPO size of 1,60,00,000 shares (Rs. 168 Cr) and it will be listed at BSE and NSE.

|

IPO Opening & Closing Date |

27 May 2025 to 29 May 2025 |

|

Face Value |

Rs. 10 per Share |

|

Issue Price |

Rs. 95 to Rs. 105 |

|

Lot Size |

142 Shares |

|

Issue Size |

1,60,00,000 shares (Rs. 168 Cr) |

|

Offer for Sale |

- |

|

Fresh Issue |

1,60,00,000 shares (Rs. 168 Cr) |

|

Listing At |

BSE, NSE |

|

Issue Type |

Book Built Issue IPO |

|

Registrar |

Kfin Technologies Limited |

IPO Grey Market Premium

The live IPO GMP is available at our live IPO GMP page, where you can get the GMP today of open IPOs.

Detailed Video

Prostarm Info Systems IPO Lot Size

The IPO allows retail investors to invest in a minimum and maximum of 1 Lot (142 Shares) amounting to Rs. 14,910 and 13 Lots (1846 Shares) for Rs. 1,93,830 respectively, while for HNI investors, the minimum Lot is 14 (1988 Shares) amounting to Rs. 2,08,740.

|

Minimum Lot Investment (Retail) |

1 Lot |

|

Maximum Lot Investment (Retail) |

13 Lots |

|

S-HNI (Minimum) |

14 Lots |

|

S-HNI (Maximum) |

67 Lots |

|

B-HNI (Minimum) |

68 Lots |

IPO Reservation

|

Institutional Share Portion |

50% |

|

Retail Investors' Share Portion |

35% |

|

Non-Institutional Shares Portion |

15% |

Promoters and Management of Prostarm Info Systems Ltd.

-

Ram Agarwal,

-

Sonu Ram Agarwal,

-

Vikas Shyamsunder Agarwal.

|

Pre-Issue Promoter Shareholding |

100% |

|

Post-Issue Promoter Shareholding |

72.82% |

IPO Lead Managers

-

Choice Capital Advisors Pvt Ltd.

Dividend Policy

The company hasn’t paid a dividend in any three FYs preceding the date of RHP.

Conclusion

Prostarm Info Systems IPO presents as an investment opportunity, considering its impressive balance sheets, diversified product portfolio, and an established client base spread out across India. The IPO seems fairly priced, with the company quoted at a P/E of 19.30x compared to the industry standard of 149x.

Finowings IPO Analysis

Hope you enjoyed the Finowings IPO Analysis. We tried our best to give every required detail about the company that you should know before applying to the IPO.

You must consult your financial advisor before making any financial decisions.

To Apply for the IPO, Click Here.

To Read the Prospectus of the Company Click Here to Download the DRHP.

Click Here To Stay Updated With The Upcoming IPOs.

DISCLAIMER: This IPO blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

The size of this IPO is 1,60,00,000 shares (Rs. 168 Cr).

If you have applied for the IPO but have not been allotted the Shares by the Registrar and are now looking for “ what to do if the IPO refund is not received ”, is not received," we discussed the blog post that details how to obtain your IPO refund.

The date of listing of this offer is 03 June 2025.

Its IPO price is Rs. 95 to Rs. 105.

The size of Prostarm IPO is 1,60,00,000 shares aggregating to Rs. 168 Cr.