A beginner’s journey of trading or investment starts with opening a Demat account with an authentic broker. The first step in entering the trading world is to study, learn and acknowledge the credibility of various companies listed in the stock market.

As an Indian trader or investor, you must gain knowledge of the listed companies – small cap, medium cap or large cap with their performance in the business and the market.

We aim to simplify the technical analysis process for everyone. Thus, as an intraday trader, you should be able to pick up the right stocks to practice the strategies.

Let’s be honest, you are here to make money! And, to do that you would need to consider the rules below and get your stock market beginner guide.

1. Always Choose Liquid Stocks for Intraday Trading

A liquid stock is defined by its ability to buy or sell stocks in abundance without affecting the price of a stock.

Liquidity of the stock matters for intraday traders, investors and swing traders because a shorter investment horizon requires accessible buyers and sellers in the market.

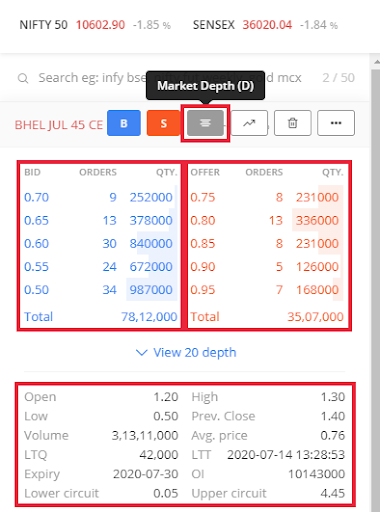

For example, a liquid stock will have buyers and sellers at every level. As you can observe in the figure above that at each level of the stock there are buyers and sellers present.

Liquidity matters for intraday traders because it offers tight spreads between each price level and develops certainty for the traders. An illiquid stock will have a high price spread which might make your trade uncertain for the day.

A liquid stock saves you from slippage in the market. If there is an uncertain behaviour of the stock, liquidity of the stock ensures squaring off instantly.

2. Identify Liquid Stocks in 3 Steps

# Step 1 Identify Volume: High trading volume indicates that the stock is in demand which ensures it is a liquidity stock list for you.

# Step 2 Low difference between ask and bid price: Ask price is the buy price and bid price is the selling price. A low difference between the ask and buy price can ensure that a stock is liquid in the market.

# Step 3 High Float: Float is considered as the shares available in the market for trading through publicly owned traders. A high volume during high float ascertains that the stock is highly liquid in the market.

3. Always Choose Credible and Transparent Companies

It is always wise to choose companies that make available sufficient financial and technical information for the public. A credible company does not hide its business operations from the market which makes it transparent to select for trading.

Transparent companies should only be considered for intraday trading. A stable business ensures a stable momentum of the stock whereas, a business that hides information often brings down the trader’s wealth.

3.1 Use 5 criteria to pick the most credible companies

3.1.1 Projected Profitability

A trader needs to look for the fundamentals of the company before choosing the stock for technical analysis. The factors projected for a company such as earnings, profits, operating margins and cash flow develop reasonably assessment to analyse the financial health of the company.

3.1.2 Capital Structure

A capital structure refers to the structure of how a business utilizes its profits or earnings in growing its performance. A conservative capital structure is formed by a company to create short-term liquidity and ensure finance expansion at the same time.

3.1.3 Earnings

The earnings momentum is important to analyse before selecting a company. It is important to analyse every quarter whether the earnings are accelerating or decreasing with time.

3.1.4 Asset Utilization

Asset utilization should be above 70% for a stock which derives that it is competitive in the market. Before selecting the stock, make sure to find out the asset utilization score of a company.

3.1.5 Intrinsic Value

Intrinsic value is measured by the worth of an asset of the company. Investors or traders can find this information online through authentic websites. Ideally, you should select stocks whose intrinsic value is greater than their market value.

This is how you find a company’s stock credible before trading in them.

4. Watch the Sensitive Stocks

Sensitive stocks are the companies that are influenced by changes in interest rates, bank rates or any other changes in the system.

For example, the consumer staples, financial industry, real estate, healthcare etc are the sectors sensitive to interest rates.

Often the sensitivity in a stock price is identified through the influence of on-the-spot news. Hence, it is crucial for you to follow the news on your watchlist. Stock prices tick up and down due to the immediate fluctuation of demand and supply.

-

Always follow the quarterly financial reports of the listed companies to observe the performance of the company in the past quarter.

-

Always keep in check with global events like presidential elections, trade wars etc to save your fund from unexpected havoc.

-

Always read government economic reports to understand the strength and weaknesses of your country’s economy.

5. Analyse the volume, trend and performance

Volume Analysis of a company’s stock can signal the time to enter the stock. If you observe a stock with high volume, you will know that it is developing a sustainable move in the market. The higher the volume is, the higher will be the demand for that stock. Thus, stock selection is important on the basis of volume.

Trend Analysis of a stock is important as it brings several advantages. Trend in pricing with strong trends allow the traders to align themselves with a stock which trends often. Many experienced traders follow stocks that are trending or have the most obvious trend moves. You can find a trending stock for the day from Top Losers and Top Gainers chart while you pick a stock for your watchlist.

Performance Analysis is conducted by observing the price-to-earnings ratio to measure the stock’s price over its earnings per share. Evaluation of stock’s performance can you in-stock selection. Stock performance also refers to the gains, losses, return on shares and dividends that traders or investors receive over time.

6. Monitor your watchlist

An investor or trader creates a watchlist consisting of stocks from several sectors and industries. When you are confident to follow the above four rules while you pick your stocks, make sure to prepare a watchlist for the stocks selected.

An effective watchlist is built using three steps:

-

Collect liquid stocks from major sectors

-

Analyse them through fundamental and technical criteria

-

Rescan the list every day

The third step is to rescan or monitor the selected stocks every day as per their performance, stability, growth, market approach and news. Monitoring constantly these stocks may help you generate the best company stocks from the market.

Keep track of the related events such as dividend date, quarterly results, stock split, buyback and right issue. These events initiate changes in the stock that is beneficial for the traders to trade in them from time to time.

Tip: We have a tip for you! If you turn on the stock tickers on your broker’s app, you will receive a push notification with “how your watchlist did today”.

Bottom Line

You need to select your own stocks based on your research process. There might be an app for stock selection or any other website, but when you analyse stocks based on your knowledge it is authentic, credible and belongs to the current market trend.

Don’t forget …

-

Always Choose Liquid Stocks by identifying volume, high float and the difference between ask & bid price.

-

Select transparent companies with projected profits, earnings, conservative capital structure, intrinsic value over market value and asset utilization.

-

Follow news related to your stocks that are sensitive in nature – quarterly reports, government economic reports and global trends.

-

Analyse volume, trend and performance when you select the stocks.

-

Monitor your selected stocks’ watchlists daily to analyse their performance as per the market trends.