Home >> IPO >> Aegis Vopak Terminals IPO: Price, Overview, And GMP

Aegis Vopak Terminals IPO: Price, Overview, And GMP

Table of Contents

- Aegis Vopak Terminals IPO - Complete Overview

- Aegis Vopak Terminals IPO Details

- Company Financial

- The Objective of the Issue

- Peers of Aegis Vopak Terminals

- Evaluation

- IPO's Strengths

- IPO’s Weaknesses

- Aegis Vopak Terminals IPO GMP Today

- Promoters and Management of Aegis Vopak Terminals Ltd.

- IPO Lead Managers

- Dividend Policy

- Conclusion

Aegis Vopak Terminals IPO - Complete Overview

Aegis Vopak Terminals IPO, a Mainboard IPO, is a book-built issue of Rs. 2,800 Cr (11.91 Cr Shares) by Aegis Vopak Terminals Limited, incorporated in 2013 and is involved in the operation and management of storage facilities for Liquefied Petroleum Gas (LPG) and other liquid products.

AVTL is responsible for the safe custody of Propane, Butane, and other products like petroleum, chemicals, vegetable oils, and lubricants. The infrastructure that accompanies the storage includes, but is not limited to:

The company gasifies and stores vegetable products along with chemicals, currently with 70,800 metric tons (MT) of gas capacity. By June 30 of 2024, the company will have approximately 1.50 million cubic meters of gas storage and 1.50 million cubic meters of liquid product storage distributed throughout.

It operates its business through two main divisions:

Gas Terminal Division – sole focus on the storage and handling of Liquefied Petroleum Gas (LPG).

Liquid Terminal Division – manages the storage of a wide variety of liquid products, including but not limited to: Petrol, Chemicals, and Vegetable oils. The number of types of chemicals and oils stored exceeds 30 and 1,0, respectively.

The private company under consideration possesses 2 LPG gas terminals and 16 liquid terminals, which are located in the five major ports of India. The Terminal handles coastal shipping, imports, and exports.

Haldia, W.B, Kochin, Kerala, Mangalore, Karnataka, Pipavav, Gujarat, Kandla, Gujarat are the ports capable of storing liquid approximately 1.50 million cu/mtr.

This new IPO is to be launched on 26 May 2025, and its ‘initial public offering’ will end on 28 May 2025.

Aegis Vopak Terminals IPO Details

This Mainline IPO comprises a wholly fresh issue of 11,91,48,936 Shares. The Aegis Vopak Terminals IPO date of listing is June 02, 2025. The Aegis Vopak Terminals IPO price is between Rs. 223 to Rs. 235 for each Share.

If you want to apply for the IPO, click to open a Demat Account.

Company Financial

(Amount in Cr)

|

Period |

31 Dec 2024 |

31 Mar 2024 |

31 Mar 2023 |

|

Total Assets |

5,855.60 |

4,523.40 |

3,481.48 |

|

Total Revenue |

476.15 |

570.12 |

355.99 |

|

PAT |

85.89 |

86.54 |

-0.08 |

|

Net Worth |

2,037.61 |

1,151.94 |

1,098.20 |

|

Reserves & Surplus |

- |

- |

- |

|

Borrowings |

2,485.75 |

2,586.42 |

1,745.17 |

Cash Flows

The cash flows for various activities are shown below:

(Amount in millions)

|

Net Cash Flow In Multiple Activities |

31 Mar 2024 |

31 Mar 2023 |

31 Mar 2022 |

|

Net Cash Flow Operating Activities |

3,372.08 |

1,724.86 |

5.01 |

|

Net Cash Flow Investing Activities |

(8,574.79) |

(17,856.13) |

(922.99) |

|

Net Cash Flow Financing Activities |

6,029.39 |

16,291.70 |

986.34 |

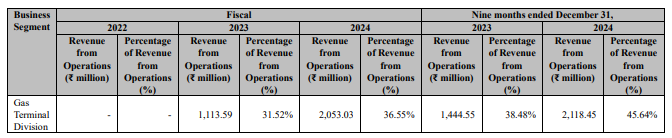

Revenue from Business Segment Breakdown

Revenue Breakdown from Services

(Amount in million)

(Source RHP)

The Objective of the Issue

-

Whole or partial repayment or settlement of the business's outstanding debt.

-

Financing capital expenditures for the negotiated purchase of Mangalore's cryogenic LPG terminal.

-

To meet corporate objectives.

Peers of Aegis Vopak Terminals

|

Company Name |

Face Value (Rs.) |

EPS (Rs.) |

P/E (x) |

|

Adani Ports And Special Economic Zone Ltd. |

2 |

37.55 |

37.48 |

|

JSW Infrastructure Limited |

2 |

6.01 |

49.42 |

Evaluation

The Aegis Vopak Terminals Limited IPO price is Rs. 223 to Rs. 235 for each Share.

Evaluation of P/E Ratio

Considering the FY ended 31 Mar 2024 with an EPS of Rs. 1 from the last year, the resulting P/E ratio is 235x.

Considering the weighted EPS of Rs. 0.50 for the last three years, the P/E ratio is 470x.

The Belrise Industries IPO application window is open till today only.

Comparative Analysis With Listed Peers

The average P/E Ratio of the industry is 43.25.

|

Particulars |

P/E Ratio (x) |

|

Highest |

49.02 |

|

Lowest |

37.48 |

|

Average |

43.25 |

In simple words, the P/E ratio of this IPO (235x), compared with the industry’s average P/E of 43.25x, has an overvaluation (on a P/E ratio basis only). Hence, the price of the Share seems aggressively priced for the investors when considered based on the average P/E ratio of the industry.

IPO's Strengths

-

India's largest third-party tankage operator for LPG & liquid storage by capacity.

-

61% of India's LPG and 23% liquid imports are handled by strategic port locations.

-

Infrastructure expansion & storage efficiency proven track record.

-

This is feasible operations focused on ESG with advanced safety & sustainability systems.

IPO’s Weaknesses

-

High levels of revenue dependence on the top 10 customers raise concentration risk.

-

Portional risks with respect to hazardous material handling and being port-based vulnerabilities.

-

Lease agreements on some terminals expired and have not been renewed yet.

Aegis Vopak Terminals IPO GMP Today

Aegis Vopak Terminals IPO GMP is Rs. 0 as of May 23, 2025, when this information was written. With the price of Rs. 235, the Aegis Vopak Terminals IPO listing price might be Rs. 235 (estimated).

Aegis Vopak Terminals Limited IPO Timetable (Tentative)

The Aegis Vopak IPO dates are between May 26 to May 28. With IPO allocation on May 29, refund initiation on May 30, and listing on Jun 02, 2025.

|

Events |

Date |

|

IPO Opening Date |

26 May 2025 |

|

IPO Closing Date |

28 May 2025 |

|

IPO Allotment Date |

29 May 2025 |

|

Refund Initiation |

30 May 2025 |

|

IPO Listing Date |

02 Jun 2025 |

IPO Other Details

The IPO with a face value of Rs. 10 per Share, offers an IPO size of 11,91,48,936 Shares (Rs. 2800 Cr) and it will be listed at BSE and NSE.

|

IPO Opening & Closing date |

26 May 2025 to 28 May 2025 |

|

Face Value |

Rs. 10 per Share |

|

Issue Price |

Rs. 223 to Rs. 235 |

|

Lot Size |

63 Shares |

|

Issue Size |

11,91,48,936 Shares (Rs. 2800 Cr) |

|

Offer for Sale |

- |

|

Fresh Issue |

11,91,48,936 Shares (Rs. 2800 Cr) |

|

Listing At |

BSE, NSE |

|

Issue Type |

Book Built Issue IPO |

|

Registrar |

Link Intime India Private Ltd. |

IPO GMP

The GMP IPO is available at our live IPO GMP page, where you get the new IPO GMP of open IPOs and the GMP of upcoming IPO.

Detailed Video

Aegis Vopak Terminals IPO Lot Size

The IPO allows retail investors to invest in a minimum and maximum of 1 Lot (63 Shares) amounting to Rs. 14,805 and 13 Lots (819 Shares) for Rs. 1,92,465 respectively, while for HNI investors, the minimum Lot is 14 (882 Shares) amounting to Rs. 2,07,270.

|

Minimum Lot Investment (Retail) |

1 Lot |

|

Maximum Lot Investment (Retail) |

13 Lots |

|

S-HNI (Minimum) |

14 Lots |

|

S-HNI (Maximum) |

67 Lots |

|

B-HNI (Minimum) |

68 Lots |

IPO Reservation

|

Institutional Share Portion |

75% |

|

Retail Investors' Share Portion |

10% |

|

Non-Institutional Shares Portion |

15% |

Promoters and Management of Aegis Vopak Terminals Ltd.

-

Aegis Logistics Limited

-

Huron Holdings Limited

-

Trans Asia Petroleum INC

-

Asia Infrastructure Investment Limited

-

Vopak India B.V.

-

Koninklijke Vopak N.V.

|

Pre-Issue Promoter Shareholding |

97.41% |

|

Post-Issue Promoter Shareholding |

85.93% |

IPO Lead Managers

-

ICICI Securities Limited

-

BNP Paribas, IIFL Securities Ltd.

-

Jefferies India Private Limited

-

HDFC Bank Limited.

Dividend Policy

The company has paid a dividend of Rs. 290 and Rs. 38.62 per Share, in FY24 and FY23, respectively.

Conclusion

Aegis Vopak Terminals IPO is an opportunity due to a robust storage footprint from industry-leading facilities in select strategic ports. Despite the high P/E, however, another word of caution is what it stands for investors.

Finowings IPO Analysis

Hope you enjoyed the Finowings IPO Analysis. We tried our best to give every required detail about the company that you should know before applying to the IPO.

You must consult your financial advisor before making any financial decisions.

To Apply for the IPO, Click Here.

To Read the Prospectus of the Company Click Here to Download the DRHP.

Click Here To Stay Updated With The Upcoming IPOs.

DISCLAIMER: This IPO blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

The size of this IPO is 11,91,48,936 Shares (Rs. 2800 Cr).

If you have applied for the IPO but have not been allotted the Shares by the Registrar and are now looking for “ what to do if the IPO refund is not received ”, is not received," we discussed the blog post that details how to obtain your IPO refund.

The date of listing of this offer is 02 June 2025.

Its IPO price is Rs. 223 to Rs. 235.