Home >> IPO >> Scoda Tubes IPO: Price, Allotment, Size, And GMP

Scoda Tubes IPO: Price, Allotment, Size, And GMP

Table of Contents

Scoda Tubes IPO - Complete Overview

Scoda Tubes IPO, a Mainboard IPO, is a book-built issue of Rs. 220 Cr (1.57 Cr Shares) by Scoda Tubes Limited, which was incorporated in 2008 and deals in stainless steel tubes and pipes.

The products of the company are separated broadly into two forms: seamless tubes/pipes and welded tubes/pipes. These are divided into separate product lines of which are further subdivided into five.

-

Stainless steel seamless pipe

-

Stainless steel seamless tubes

-

Stainless steel seamless U Tubes

-

Stainless steel instrumentation tubes

-

SS welded tubes and ‘U’ Tubes

Scoda Tubes Ltd. is the brand under which the company markets its products to customers.

Customers - Engineering Companies, EPCs ( a combination of engineering, procurement, and construction) in sectors that are among oil and gas [chemicals, fertilizer, superpowerpharmaceuticals, automobile, locomotive, and transport.

Industries and Manufacturing :

-

The operation of a soft piercing mill for mother hollow production is the main raw material for the products.

-

Manufacturing Facility: HQ Location on Ahmedabad-Mehsana Highway in Rajpur Kadi, Mehsana-Gujarat

FY24 Market presence

-

Delivered goods to 49 stockists in Domestic and international markets.

-

Exported to 16 countries: The US, Germany, the Netherlands, Italy, Spain, and France.

Distribution Network

-

India: Maharashtra (Authorised Stockist)

-

United States: Products are vend out exclusively by the US-enabled stockist.

-

Europe: Products are served through stockists in Germany, Austria, and Eastern European markets.

This new IPO is to be launched on 28 May 2025, and its ‘initial public offering’ will end on 30 May 2025.

Scoda Tubes IPO Details

This Mainline IPO comprises a wholly fresh issue of 1,57,14,286 Shares (Rs. 220 Cr). The Scoda Tubes IPO listing date is 04 June 2025. The Scoda Tubes IPO price is between Rs. 130 to Rs. 140 for each Share.

If you want to apply for the IPO, click to open a Demat Account.

Company Financial

(Amount in Cr)

|

Period |

31 Dec 2024 |

31 Mar 2024 |

31 Mar 2023 |

|

Total Assets |

428.49 |

330.42 |

238.26 |

|

Total Revenue |

363.48 |

402.49 |

307.79 |

|

PAT |

24.91 |

18.30 |

10.34 |

|

Net Worth |

143.55 |

63.61 |

45.31 |

|

Reserves & Surplus |

99.35 |

62.33 |

44.03 |

|

Borrowings |

202.16 |

202.66 |

139.31 |

Cash Flows

The cash flows for various activities are shown below:

(Amount in million)

|

Net Cash Flow In Multiple Activities |

31 Dec 2024 (Nine Months) |

31 Mar 2024 |

31 Mar 2023 |

|

Net Cash Flow Operating Activities |

54.23 |

22.64 |

203.46 |

|

Net Cash Flow Investing Activities |

(426.38) |

(465.76) |

(385.23) |

|

Net Cash Flow Financing Activities |

382.98 |

442.65 |

179.36 |

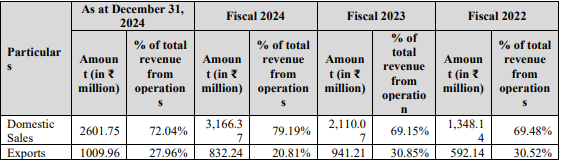

Revenue from operations Bifurcation

Products-wise Revenue Bifurcation

(Source RHP)

The Objective of the Issue

-

Investment to increase the capacity for producing seamless and welded pipes and tubes.

-

Paying for the company's partially increased working capital needs.

Peers of Scoda Tubes

|

Company Name |

Face Value (Rs.) |

EPS (Rs.) |

P/E (x) |

|

Ratnamani Metals & Tubes Ltd. |

2 |

89.18 |

31.93 |

|

Venus Pipes & Tubes Limited |

10 |

42.36 |

30.77 |

|

Welspun Specialty Solutions Ltd. |

6 |

1.18 |

27.15 |

|

Suraj Limited |

10 |

11.72 |

34.79 |

Evaluation

The Scoda Tubes Limited IPO price is Rs. 130 to Rs. 140 for each Share.

Evaluation of P/E Ratio

Considering the FY ended 31 Dec 2024 with an EPS of Rs. 4.60 from the last year, the resulting P/E ratio is 30.43x.

Considering the weighted EPS of Rs. 3.28 for the last three years, the P/E ratio is 42.68x.

The Prostarm Info Systems IPO application will be available from 27 May 2025.

Comparative Analysis With Listed Peers

The average P/E Ratio of the industry is 30.97.

|

Particulars |

P/E Ratio (x) |

|

Highest |

34.79 |

|

Lowest |

27.15 |

|

Average |

30.97 |

In simple words, the P/E ratio of this IPO (30.43x), compared with the industry’s average P/E of 30.97x, has an undervaluation (on a P/E ratio basis only). Hence, the price of the Share seems fairly priced for the investors when considered based on the average P/E ratio of the industry.

IPO's Strengths

-

Additive focuses on value-enhancing stainless steel long products.

-

Possesses strong global industry certifications and accreditations.

-

Holds a well-diversified overseas customer base.

-

Has a strategically located integrated manufacturing facility.

-

Possesses stringent quality assurance with very low rejection rates.

IPO’s Weaknesses

-

Dependence on a narrow sales and distribution stockist network.

-

The possibility of termination or underperformance by exclusive stockists.

-

Vulnerability to the potential withdrawal of unsecured loans by creditors at any point.

Scoda Tubes IPO GMP Today

Scoda Tubes IPO GMP is Rs. 16 as of May 24, 2025, when this information was written. With the price of Rs. 140, the Scoda Tubes IPO listing price might be Rs. 156 (estimated).

Scoda Tubes Limited IPO Timetable (Tentative)

The Scoda Tubes IPO date is from 28 May to 30 May. With IPO allocation on Jun 02, refund initiation on Jun 03, and listing on Jun 04, 2025.

|

Events |

Date |

|

IPO Opening Date |

28 May 2025 |

|

IPO Closing Date |

30 May 2025 |

|

IPO Allotment Date |

02 Jun 2025 |

|

Refund Initiation |

03 Jun 2025 |

|

IPO Listing Date |

04 Jun 2025 |

IPO Other Details

The IPO with a face value of Rs. 10 per Share, offers an IPO size of 1,57,14,286 shares (Rs. 220 Cr) and it will be listed at BSE and NSE.

|

IPO Opening & Closing Date |

28 May 2025 to 30 May 2025 |

|

Face Value |

Rs. 10 per Share |

|

Issue Price |

Rs. 130 to Rs. 140 |

|

Lot Size |

100 Shares |

|

Issue Size |

1,57,14,286 shares (Rs. 220 Cr) |

|

Offer for Sale |

- |

|

Fresh Issue |

1,57,14,286 shares (Rs. 220 Cr) |

|

Listing At |

BSE, NSE |

|

Issue Type |

Book Built Issue IPO |

|

Registrar |

MUFG Intime India Private Limited (Link Intime) |

IPO Grey Market Premium

The live IPO GMP is available at our live IPO GMP page, where you can get the GMP today of open IPOs.

Scoda Tubes IPO Lot Size

The IPO allows retail investors to invest in a minimum and maximum of 1 Lot (100 Shares) amounting to Rs. 14,000 and 14 Lots (1400 Shares) for Rs. 1,96,000 respectively, while for HNI investors, the minimum Lot is 15 (1500 Shares) amounting to Rs. 2,10,000.

|

Minimum Lot Investment (Retail) |

1 Lot |

|

Maximum Lot Investment (Retail) |

14 Lots |

|

S-HNI (Minimum) |

15 Lots |

|

S-HNI (Maximum) |

71 Lots |

|

B-HNI (Minimum) |

72 Lots |

IPO Reservation

|

Institutional Share Portion |

50% |

|

Retail Investors' Share Portion |

35% |

|

Non-Institutional Shares Portion |

15% |

Promoters and Management of Scoda Tubes Ltd.

-

Samarth Patel

-

Jagrutkumar Patel

-

Ravi Patel

-

Saurabh Patel

-

Vipulkumar Patel.

|

Pre-Issue Promoter Shareholding |

100% |

|

Post-Issue Promoter Shareholding |

- |

IPO Lead Managers

-

Monarch Networth Capital Ltd.

Dividend Policy

The company hasn’t paid a dividend in the last three FYs.

Conclusion

Scoda Tubes IPO stands to be a window of opportunity for those who want exposure to the segment of stainless steel pipes and tubes. With healthy financials, exports to global markets, and a fair valuation, the IPO looks attractively priced.

Finowings IPO Analysis

Hope you enjoyed the Finowings IPO Analysis. We tried our best to give every required detail about the company that you should know before applying to the IPO.

You must consult your financial advisor before making any financial decisions.

To Apply for the IPO, Click Here.

To Read the Prospectus of the Company Click Here to Download the DRHP.

Click Here To Stay Updated With The Upcoming IPOs.

DISCLAIMER: This IPO blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

The size of this IPO is 1,57,14,286 shares (Rs. 220 Cr).

If you have applied for the IPO but have not been allotted the Shares by the Registrar and are now looking for “ what to do if the IPO refund is not received ”, is not received," we discussed the blog post that details how to obtain your IPO refund.

The date of listing of this IPO is 04 June 2025.

Its IPO price is Rs. 130 to Rs. 140.