Home >> Blog >> When Will Nifty Recover? Nifty Up or Down | 5 Reasons to Know

When Will Nifty Recover? Nifty Up or Down | 5 Reasons to Know

Table of Contents

Once upon a time in the world of finance, there was a stock market index called Nifty. Nifty was like a rollercoaster, going up and down, and traders were always curious about where it would go next. They wondered, "When will Nifty hit the lowest point? When will it start going up again?"

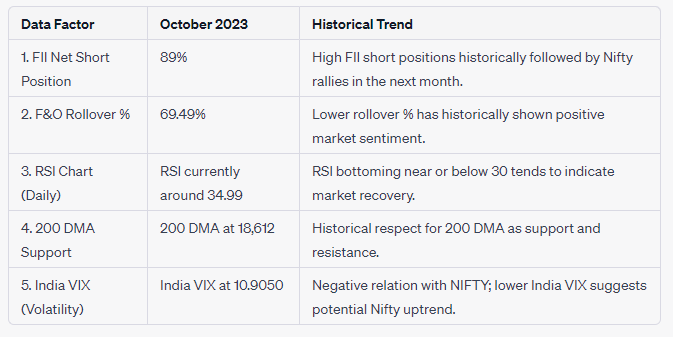

To understand Nifty's journey, they looked at five important clues:

1. FII Short Positions:

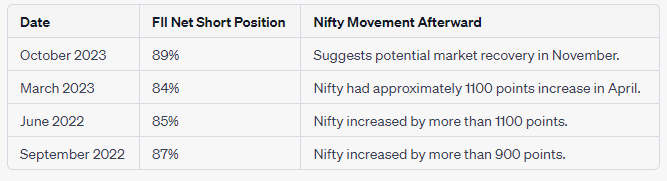

- Foreign Institutional Investors (FII) sometimes made bets against Nifty. In October 2023, they were making negative bets at 89%. Whenever they did this, history showed that Nifty usually went up the next month. For instance, in March, they had negative bets at 84%, and Nifty had a good run in April.

2. F&O Rollover Data:

- Traders played a game with contracts, and they wanted to know if others were keeping their negative bets from one month to the next. If many people kept their negative bets, it might not be good for Nifty. But if fewer people did, it could be good news.

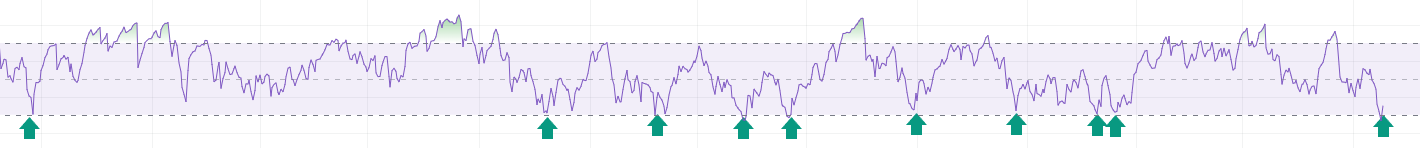

3. Technical Chart Analysis - RSI:

- Nifty had an indicator called the Relative Strength Index (RSI). When RSI went from being very low to a bit higher, it often meant Nifty was getting stronger. Right now, Nifty's RSI was around 34.99, suggesting that it might be on the road to recovery.

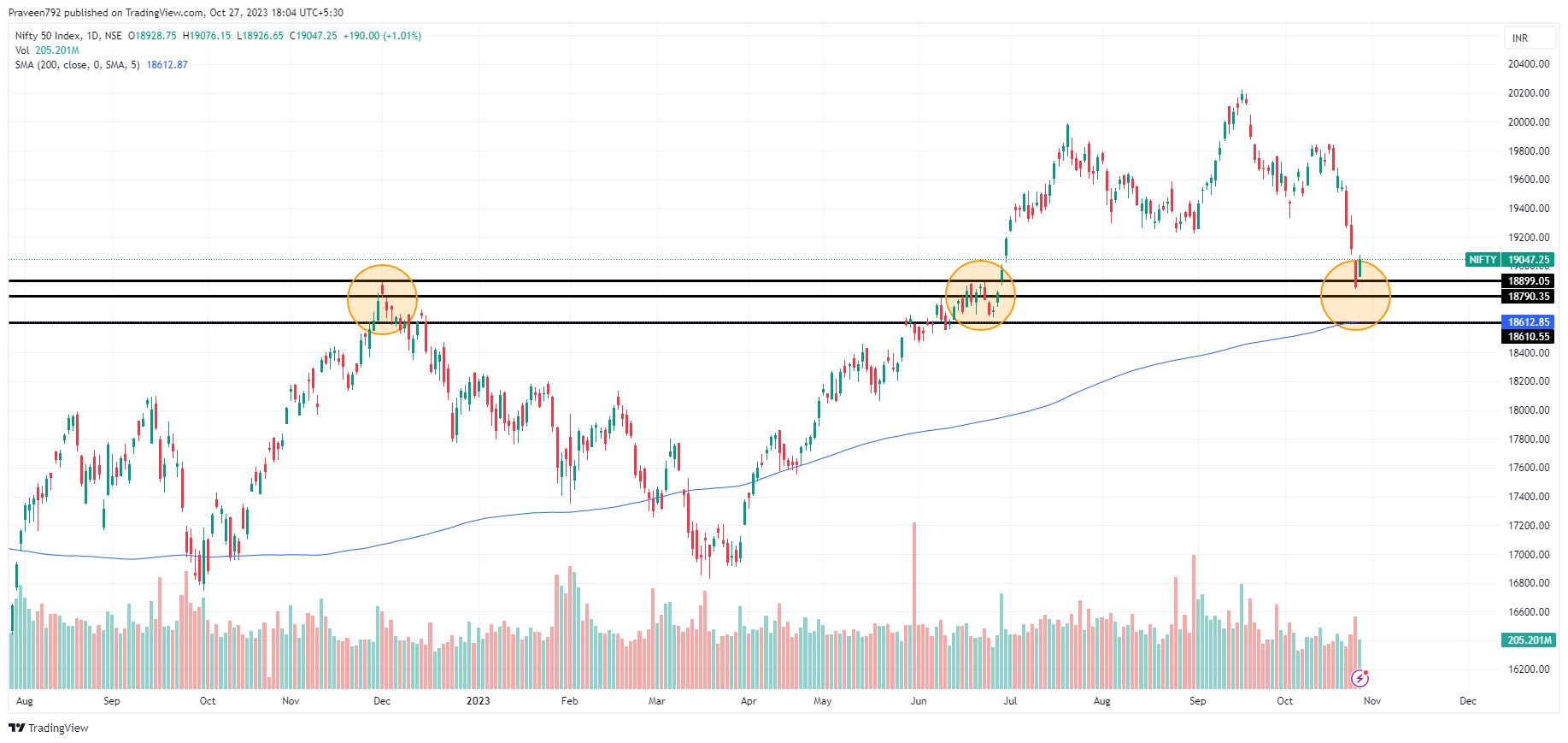

4. Technical Chart Analysis - 200 DMA:

- Nifty also had a line on its chart known as the 200-day Moving Average (DMA). If Nifty stayed above this line, it was usually a good sign. Currently, the 200 DMA was at 18,612, a level that traders watched closely for support.

5. India VIX (Volatility Index):

- There was something called the India VIX, which showed how jumpy Nifty was. When it was high, it meant Nifty was shaky. Right now, India VIX was around 10.9050, and it was going down, which could be a hint that Nifty might go up.

Putting all these clues together, it seemed like Nifty might have hit its lowest point and could be ready for a comeback. Do you think Nifty will bounce back?

If you're curious to learn more about stock trading, we offer a course that breaks it down in an easy-to-understand way. Contact us for details and share this story with anyone wanting to unlock the mysteries of the stock market.

Author

Frequently Asked Questions

Nifty is a key stock market index representing India's top 50 companies. Its performance holds significance in the financial world as it reflects the overall market health. In October 2023, Nifty's movements and various indicators are closely monitored.

FII Short Positions are bets made by foreign investors against Nifty. In October 2023, they held negative bets at 89%. Historically, when this happens, Nifty tends to go up the following month, creating intrigue among traders and investors.

Traders closely monitor F&O Rollover Data to see if others are extending their negative bets from one month to the next. In October 2023, the data indicates significant interest. How this pans out could offer insights into Nifty's potential trajectory.

RSI is a critical indicator used to gauge Nifty's strength. Currently, in October 2023, Nifty's RSI is around 34.99, suggesting it might be on the path to recovery. This level is closely followed by traders for market insights.

The 200 DMA is an important trend indicator. In October 2023, it stands at 18,612. Staying above this level is generally considered a positive sign for Nifty. Investors are keeping a watchful eye on this level for potential support or resistance.

Liked What You Just Read? Share this Post:

Viewer's Thoughts

Devendra legha | Posted on 28/10/2023

Supper analysis

Aniket chingale | Posted on 29/10/2023

Acchi jankari Di aapane

Diapk J desai | Posted on 28/10/2023

Very good analysis. Thanks a lot to Finnowing Team