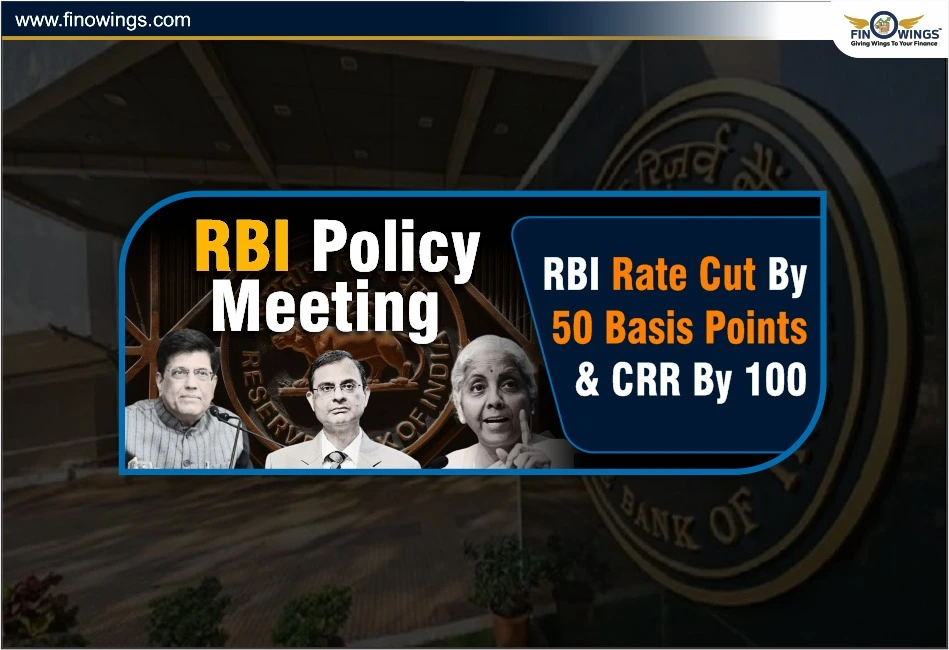

Home >> Blog >> RBI Policy Meeting: RBI Rate cut by 50 Basis Points & CRR by 100

RBI Policy Meeting: RBI Rate cut by 50 Basis Points & CRR by 100

Table of Contents

In an unexpected decision to support growth that has fallen to a four-year low of 6.5% in FY25, the RBI Governor Sanjay Malhotra lowered the repo rate by 50 basis points in the RBI MPC meeting on Friday and CRR by 100 basis points.

The benchmark policy rate slipped to a three-year low of 5.5% after the rate cut, which helped borrowers of corporate, auto, and residential loans after the RBI Policy meeting. This is the minimum repo rate in the previous three years.

RBI Rate Cut- What Does it Mean for Growth?

-

The 50 basis point rate cut by the RBI came as a wild card since our year-end projections were for a third consecutive 25bps rate cut in the RBI policy meeting today on 06 June 2025. Front-loading of rate cuts to encourage growth was always preferred by the regulator. However, since then, the stance has shifted from Accommodative to Neutral.

-

This leaves little room for more rate cuts to go through. On the other hand, a softening inflation trend that might stay within or broadly below tolerance and a recovering demand can be seen as positives.

-

It has cut the inflation forecast rate for FY26 to 3.7% from the earlier forecast of 4% while keeping the GDP growth forecast unchanged at 6.5% for FY26. The surprise CRR cut of 100bps in the RBI policy meeting spread over four tranches from Sep'25 should provide further liquidity impulse to credit growth for banks.

RBI Repo Rate & Impact on the Share Market

-

With positive news of the RBI Repo rate cut by 50bps, the broader indices like Nifty50 and the Sensex are currently trading at around +1.11% at 25026.65 and around +1% at 82263.90 respectively. The Nifty Bank is at around +1.49% at 56592.60 at the time of writing this information.

-

The CRR Rate cut has boosted banking stocks after the RBI monetary policy outcome today. The RBI also said that the Cash Reserve Ratio (CRR) would be lowered by 100 basis points, from 4% to 3%, to be applied in four tranches of 25 basis points each.

-

Over the next few months, the action is anticipated to discharge over Rs. 2.5 lac crore into the banking sector. Due to traders' expectations of better net interest margins and increased credit growth, the statement led to a surge in the purchase of banking stocks.

-

Investor mood was also charged by positive signals from Asian markets. Ahead of the U.S. start, Wall Street Futures were up, while the Kospi in South Korea and the Nikkei 225 in Japan were also trading higher.

Conclusion

RBI takes a very bold stance on interest rates, CRR cuts in order to revive economic growth with improved liquidity at banks in the RBI policy meeting today. Such measures should drive credit demand gains and favour the borrowers cycle-wise. The overall sentiment of the market lifted as Banking stocks soared. With supportive global cues, investor optimism may be sustained in the short term ahead.

Author

Frequently Asked Questions

Repo rate is the rate at which the Central Bank (RBI) lends loans to commercial banks.

Reverse Repo Rate or RRR is the rate of interest at which the RBI borrows money from commercial banks in the country.

The current repo rate of the RBI is 5.50% after the RBI cuts the rate by 50 bps in its MPC meeting held today, chaired by the RBI Governor, Sanjay Malhotra.