Home >> Blog >> An Overview Of Non-Banking Financial Companies Or NBFCs In India

An Overview Of Non-Banking Financial Companies Or NBFCs In India

Table of Contents

1. Introduction

Like banks, non-banking financial companies also play a vital part in an economy. NBFCs have worked to enhance diversification and competitiveness in the financial sector. NBFCs have extended financial services to those who do not have access to a bank. In the Indian markets, you will find a variety of institutions dealing with financial services, be it commercial bank financial institutions or non-banking finance companies. Non-banking financial institutions have grown to be an essential component of the Indian financial system, or rather, they have helped to fortify it.

NBFCs in India are often seen acting as suppliers of loans and credit facilities, but gradually NBFCs have expanded their scope to perform various banking functions today. For example, accepts deposits, operates different mutual funds, and much more. NBFCs act as a complement to banks and other financial institutions in the Indian financial market.

Today in this blog, we will discuss Non-Banking Financial Companies (NBFCs) in detail, different types of NBFCs, their benefits, and how NBFCs differ from banks. So keep reading this blog because today, you are going to learn a lot of new things.

2. What Is NBFC In India?

NBFC means non-banking financial company. That is a company that provides various types of financial services. Non-Banking Financial Companies also have to be registered by RBI. Of course, NBFCs do not have any banking licenses, but they provide specialized banking services like a bank. NBFCs generally refrain from accepting demand deposits from the public.

NBFCs are also known as non-bank financial institutions (NBFIs). It is also known as the shadow bank of the banks. Outside the traditional banking system, NBFCs in India provide their services by engaging in debt and securities issuance, retail sector-housing finance, hire purchase finance, marketing, sales insurance, equipment lease finance, and investments.

Non-Banking Financial Companies in India are designed in such a way that they provide not only financial services related to the bank but also various financial services that are not seen in banks. In India, RBI oversees the operations of NBFCs under the Reserve Bank of India Act, 1934 (3B), and issues directions too. Under the Indian Companies Act of 1956, NBFCs are registered.

Even though NBFCs function like banks, they differ from commercial banks. Despite not having a banking license, the structure of their work is so good that they work as fast as the banks or faster than the banks. Countries like America and Europe brought the culture of financial institutions like NBFCs. Financial institutions such as NBFCs in the US are classified into US non-bank financial companies and foreign non-bank financial companies, overseen by the Federal Reserve Board of the US. If you try to understand it with an example, then the significant example of a Non-Banking Financial Company (NBFC) in India is – LIC Housing Finance Limited.

3. Types Of Non-Banking Financial Companies (NBFCs)?

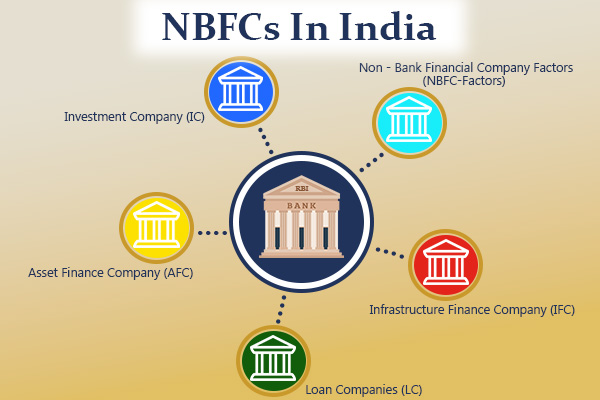

There are different types of Non-Banking Financial Companies (NBFCs):-

3.1 Asset Finance Company (AFC)

An asset finance company (AFC) includes those economic activities that help finance physical assets. Physical assets can be of many types, such as generator sets, earth movers, automobiles, machines, material equipment, etc.

3.2 Investment Company (IC)

Generally, Investment Companies (ICs) carry out their business activities to acquire securities like equity, shares, debentures, etc.

3.3 Loan Company (LC)

Under loan companies, services like loans or advance finance are provided for business or any activity.

3.4 Infrastructure Finance Company (IFC)

A financial company can be classified as an infrastructure company only if at least 75% of the assets of that company are in infrastructure loans, the credit rating of the company is in 'A,' the net fund of the company is at least 300 crores as well as having a CRAR ratio of 15%. Therefore, only that company can function as an Infrastructure Finance Company (IFC).

3.5 Systemically Important Core Investment Company (CIC-ND-SI)

This type of NBFC company often does most of its business in acquiring shares and securities of the company. A financial company will be considered as CIC-ND-SI only if 90% of the total assets of that company are invested in securities of companies, about 60% of the total assets are invested in equity shares, the size of the total assets of the company is more than 100 crores and is not involved in activities other than investment. Therefore, only that company can be classified in this category.

3.6 Infrastructure Debt Fund Non-Banking Financial Company (IDF-NBFC)

Often such NBFC companies provide long-term credit facilities for infrastructure projects, as these companies have good cash flow. These companies have a minimum maturity period of 5 years, for which they issue finance through rupees or dollar bonds.

3.7 Non-Banking Financial Company-Micro Finance Institution (NBFC-MFI)

This NBFC company accepts non-deposits, and 85% of its assets meet the following criteria:-

-

The total loan of an individual should not exceed Rs 1 lakh.

-

Under this, loans are granted to people with a more rural background whose annual income should not exceed 1 lakh. The maximum annual income limit for urban individuals increases to Rs 1.6 lakh.

-

The loan should not exceed 50K in 1 cycle and 1 lakh in a consecutive cycle.

-

The borrower can repay the loan in weekly, monthly, or biweekly installments.

-

For loans above ₹15,000, the repayment period should not be less than 24 months.

3.8 Non-Banking Financial Company-Factor (NBFC-Factor)

These types of NBFC companies use factoring to get into the financial business. Such companies should have more than 50% of their gross income from factoring and a minimum of 50% of their total assets through factoring themselves.

3.9 Mortgage Guarantee Company (MGC)

Mortgage guarantee companies are NBFC companies that have a net corpus of ₹100 crores, and about 90% of their total assets income comes from mortgage guarantees.

4. What Is The Difference Between Banks And NBFCs (Bank vs. NBFC)?

|

Bank |

NBFC |

|

In India, banks are licensed financial institutions controlled by the government or RBI under the RBI Act of 1934 and the Banking Regulation Act of 1949 |

On the other hand, NBFCs are not licensed and regulated by RBI under the RBI Act 1934 and 2013. |

|

The bank provides various services to its customers, such as advance loans, credit-debit card facilities, check payments, remittance of funds, and guarantees, etc. |

Whereas NBFCs are known to provide services like stocks, insurance facilities, savings, and investment plans, mutual funds, etc. to their customers. |

|

Banks' primary business in India is accepting deposits and making necessary loans. |

However, financial institutions like NBFCs receive deposits mainly through securitization, which differs from banks. |

|

The deposits accepted in the bank are repayable on demand. |

Whereas there is no such facility in NBFCs. |

|

The sizable difference between banks and NBFCs is that only up to 74% foreign investment is allowed in banks. |

Whereas institutions like NBFCs are allowed up to 100% foreign investment. |

|

The primary functions of banks include payment and settlement cycles. |

On the other hand, NBFCs do not involve any such payment or settlement cycle. |

|

Do you know banks are compulsorily required to maintain Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR)? |

Whereas in NBFCs, such a ratio is not required to be maintained. |

|

Banks can provide such through Credit Guarantee Corporation (DICGC). |

NBFCs cannot afford deposit insurance facilities. |

|

Banks can create credit themselves. |

NBFCs are not allowed to create credit. |

|

People have more trust in banks. This is because banks provide facilities like deposits, cheques, cash withdrawals, and debit card payments. Now almost all banks also have online payment facilities for the transaction-related process. |

NBFCs don't provide such a facility. |

5. What Are The Advantages Of NBFCs?

-

The considerable advantage of NBFCs is that NBFCs are more profitable than banks. Since it has low cost, it provides loans to customers at low-interest rates. Most of the customers of NBFCs also believe that getting loans from here is easier than from banks. Lengthy paperwork and stringent rules are faced to get a loan from banks. NBFCs provide finance to both the public and private sectors at low-interest rates.

-

NBFC helps share portfolios and stocks well, which helps in wealth management.

-

NBFC invests in various instruments of the money market.

-

Registering in NBFCs is much easier than in banks.

-

It also provides Education Loan.

-

The repayment of loans in NBFCs is quite easy, as there is no penalty clause.

-

NBFCs pay as much attention to small borrowers as they do to large borrowers.

-

NBFCs process are much faster than the bank.

-

NBFCs also help in retirement planning.

-

We all know how strict the bank is in providing loans for people without a good background. NBFCs do not discriminate in terms of lending. If you are eligible, you will get the loan quickly.

6. Conclusion

Both banks and NBFIs form a major and significant element of the Indian financial system. The demand for finance is increasing among the people, and the banking system alone cannot bear this burden. In such a situation, non-bank financial companies (NBFCs) have worked to reduce this burden to a great extent and have provided loans and investment options to the people. As a result, NBFCs have reduced dependence on the bank. The popularity of NBFCs or NBFIs in India is growing very fast, and these companies have a lot of scope in India. However, the banking system and NBFC have limitations; remember that you should go ahead with any option.

Author

Frequently Asked Questions

NBFC means non-banking financial company. NBFCs do not have banking licenses but provide specialized banking services like a bank.

Yes, but not all NBFCs are authorized to accept deposits.

The most significant difference between a bank and an NBFC is that an NBFC cannot accept demand deposits or create credit.

Banking laws do not apply to NBFCs. However, NBFCs are governed by the RBI Act of 1934.