Home >> IPO >> Brigade Hotel Ventures IPO: Date, Overview, And GMP

Brigade Hotel Ventures IPO: Date, Overview, And GMP

Table of Contents

- Brigade Hotel Ventures IPO - Complete Overview

- Brigade Hotel Ventures IPO Details

- Company Financial

- The Objective of The Issue

- Peers of Brigade Hotel Ventures Ltd.

- Evaluation

- IPO's Strengths

- IPO’s Weaknesses

- Brigade Hotel Ventures IPO GMP

- Promoters And Management of Brigade Hotel Ventures Ltd.

- Brigade Hotel Ventures IPO Lead Managers

- Dividend Policy

- Conclusion

Brigade Hotel Ventures IPO - Complete Overview

Brigade Hotel Ventures IPO, a Mainboard IPO, is a book-built issue of Rs. 759.60 Cr (8.44 Cr Shares) by Brigade Hotel Ventures Limited. The company is the proprietor and developer of hotels situated in principal urban centres of India, with its principal concentration in the southern region. The entity is a wholly-owned subsidiary of BEL, a preeminent real estate developer in the country.

The company controls a portfolio of chain-affiliated hotels and accommodations within the southern states of Kerala, Andhra Pradesh, Tamil Nadu, Karnataka, and Telangana, in addition to the UTs of Lakshadweep, Andaman and Nicobar Islands and Puducherry. It ranks among the principal institutional owners of private hotel assets, defined as those possessing a minimum of 500 keys on a national basis, as of 31 March 2025.

The hotels here integrate a truly fine European-aligned guest experience with fine/dining and specialty cuisine, MICE facilities, lounges, pools and landscaped outdoor venues, as well as wellness spas and fitness centres.

The portfolio presently includes nine functional hotels in Bengaluru and Mysuru, Karnataka; Chennai, Tamil Nadu; Kochi, Kerala; and at the GIFT City in Gujarat, with a total of about 1,604 keys. The properties are being run by top international hotel brands including Marriott, Accor and InterContinental Hotels Group.

This new IPO is to be launched on 24 July 2025, and the initial public offering of this upcoming IPO will end on 28 July 2025.

If you want to apply for the IPO, click to open a Demat Account.

Brigade Hotel Ventures IPO Details

The Rs. 759.60 crore mainline IPO comprises a wholly fresh issue of 8.44 crore shares.

The Brigade Hotel Ventures IPO GMP listing date is on Thursday, 31 July 2025, and it will be listed at BSE and NSE. The Brigade Hotel Ventures IPO price band is Rs. 85 to Rs. 90 for each Share.

Company Financial

(Amount in Cr)

|

Period |

31 Mar 2025 |

31 Mar 2024 |

31 Mar 2023 |

|

Total Assets |

947.57 |

886.78 |

840.67 |

|

Total Revenue |

470.68 |

404.85 |

356.41 |

|

PAT |

23.66 |

31.14 |

-3.09 |

|

Net Worth |

78.58 |

58.74 |

33.81 |

|

Borrowings |

617.32 |

601.19 |

632.50 |

Cash Flows

The cash flows for various activities are shown below:

(Amount in millions)

|

Net Cash Flow In Multiple Activities |

31 Mar 2025 |

31 Mar 2024 |

31 Mar 2023 |

|

Net Cash Flow Operating Activities |

1,489.50 |

1,548.60 |

1,078.70 |

|

Net Cash Flow Investing Activities |

(949.90) |

(453) |

9.80 |

|

Net Cash Flow Financing Activities |

(817.90) |

(921.30) |

(1,322.40) |

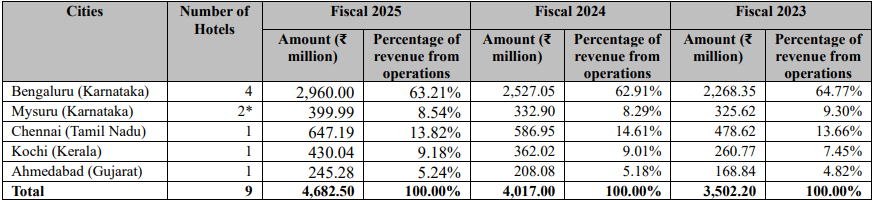

Revenue from Cities Breakdown

Hotels-wise Revenue Bifurcation

Room Nights-wise Revenue Bifurcation

Customer-wise Revenue Bifurcation

(Source RHP)

The Objective of The Issue

-

Repayment/prepayment, in full or partly, of certain outstanding borrowings availed by the company and Material Subsidiary, namely, SRP Prosperita Hotel Ventures Limited.

-

Payment of consideration for the purchase of an undivided share of land from the Promoter, BEL.

-

Inorganic growth by way of unidentified acquisitions and other strategic initiatives.

-

General corporate purposes.

Click to check the IPO application status.

Peers of Brigade Hotel Ventures Ltd.

|

Company Name |

Face Value (Rs.) |

EPS (Rs.) |

P/E (x) |

|

The Indian Hotels Company Limited |

1 |

13.40 |

56.06 |

|

EIH Limited |

2 |

11.82 |

32.20 |

|

Chalet Hotels Limited |

10 |

6.53 |

136.63 |

|

Juniper Hotels Limited |

10 |

3.20 |

99.48 |

|

Lemon Tree Hotels Limited |

10 |

2.48 |

62.04 |

|

Samhi Hotels Limited |

1 |

3.84 |

62.75 |

|

Apeejay Surendra Park Hotels Limited |

1 |

3.92 |

42.05 |

|

Ventive Hospitality |

1 |

6.83 |

115.58 |

|

ITC Hotels |

1 |

3.05 |

78.20 |

|

Schloss Bangalore Limited |

10 |

1.97 |

229.34 |

Detailed Video

Evaluation

The Brigade Hotel IPO price is between Rs. 85 to Rs. 90 for each Share.

Evaluation of P/E Ratio

Considering the period of FY 2025, with an EPS of Rs. 0.72 from the last year, the resulting P/E ratio is 125x.

Considering the weighted EPS of Rs. 0.63 for the last three years, the P/E ratio is 142.85x.

Explore the GNG Electronics IPO.

Comparative Analysis With Listed Peers

The average P/E Ratio of the industry is 91.43x.

|

Particulars |

P/E Ratio (x) |

|

Highest |

229.34 |

|

Lowest |

32.20 |

|

Average |

91.43 |

In simple words, the P/E ratio of this IPO is 125x, compared with the industry’s average P/E of 91.43x, indicating an overvaluation (on a P/E ratio basis only). Hence, the price of the Share seems aggressively priced for the investors when considered based on the average P/E ratio of the industry.

IPO's Strengths

-

The hotel portfolio is strategically located within principal metropolitan corridors-Bengaluru, Kochi, and Chennai-ensuring close access to international airports, technology parks, and principal commercial districts; this locational advantage serves the dual needs of corporate and leisure segments with equal efficacy.

-

Properties are managed within the frameworks of acclaimed international brands-Sheraton, Four Points by Sheraton, and Holiday Inn-whose worldwide equity bolsters the portfolio’s competitive profile and supports sustained high occupancy across the asset base.

-

Enduring operational resilience is further assured by Brigade Enterprises Limited, a preeminent player in Indian real estate and hospitality, whose deep industry knowledge and substantial capital base drive cost efficiencies and create a robust financial foundation.

IPO’s Weaknesses

-

Revenue generation remains reliant on a limited number of hotel assets.

-

Hospitality is cyclic and carries vulnerability to macroeconomic recessions, geopolitical disruptions, and environmental calamities. Thus, occupancy and revenue trends are essentially changeable.

-

The organisational framework relies upon external brand affiliations and management syndications; modifications to such arrangements could disrupt operational consistency and diminish guest loyalty.

Brigade Hotel Ventures IPO GMP

Brigade Hotel Ventures IPO GMP today is Rs. 0 as of 21 July 2025, while writing this information. Hence, its estimated listing price is Rs. 90 (upper price + current GMP).

Brigade Hotel Ventures IPO Timetable (Tentative)

The IPO open date is from Jul 24 to Jul 28, with IPO allotment on Jul 29, refund initiation on Jul 29, and listing on Thursday, Jul 31, 2025.

|

Events |

Date |

|

IPO Opening Date |

Jul 24, 2025 |

|

IPO Closing Date |

Jul 28, 2025 |

|

IPO Allotment Date |

Jul 29, 2025 |

|

Refund Initiation |

Jul 29, 2025 |

|

IPO Listing Date |

Jul 31, 2025 |

Brigade Hotel Ventures IPO Details

The IPO with a face value of Rs. 10 per Share offers a total issue size of 8,44,00,000 Shares (Rs. 759.60 Cr) and will be listed at BSE and NSE.

|

IPO Opening & Closing Date |

Jul 24, 2025 to Jul 28, 2025 |

|

Face Value |

Rs. 10 per Share |

|

Issue Price |

Rs. 85 to Rs. 90 |

|

Lot Size |

166 Shares |

|

Issue Size |

8,44,00,000 Shares (Rs. 759.60 Cr) |

|

Offer for Sale |

- |

|

Fresh Issue |

8,44,00,000 Shares (Rs. 759.60 Cr) |

|

Listing At |

BSE, NSE |

|

Issue Type |

Book Built Issue IPO |

|

Registrar |

Kfin Technologies Limited |

Brigade Hotel Ventures IPO Lot Size

The IPO allows retail investors to invest in a minimum and maximum of 1 Lot (166 Shares) amounting to Rs. 14,940 and 13 Lots (2158 Shares) amounting to Rs. 1,94,220, respectively, while for HNI investors, the minimum Lot is 14 (2324 Shares) amounting to Rs. 2,09,160.

|

Minimum Lot Investment (Retail) |

1 Lot |

|

Maximum Lot Investment (Retail) |

13 Lots |

|

S-HNI (Minimum) |

14 Lots |

|

S-HNI (Maximum) |

66 Lots |

|

B-HNI (Minimum) |

67 Lots |

Brigade Hotel Ventures IPO Reservation

|

Institutional Share Portion |

75% |

|

Retail Investors' Share Portion |

10% |

|

Non-Institutional Shares Portion |

15% |

Promoters And Management of Brigade Hotel Ventures Ltd.

-

Brigade Enterprises Limited.

|

Pre-Issue Promoter Shareholding |

95.26% |

|

Post-Issue Promoter Shareholding |

74.09% |

Brigade Hotel Ventures IPO Lead Managers

-

JM Financial Limited.

Dividend Policy

The company has paid no dividends in the last three fiscal years.

Conclusion

The Brigade Hotel Ventures IPO is allowing investors to participate in a geographically and operationally strategically positioned collection of hotel properties operated under internationally recognised brands. Although the company offers operational strength, P/E measures suggest that the IPO is overpriced. Two major issues are vulnerability to outside shocks and dependence on finite resources.

Finowings IPO Analysis

Hope you enjoyed the Finowings IPO Analysis. We tried our best to give every required detail about the company that you should know before applying to the IPO.

You must consult your financial advisor before making any financial decisions.

To Apply for the IPO, Click Here.

To Read the Prospectus of the Company Click Here to Download the DRHP.

Click Here To Stay Updated With The Upcoming IPOs.

DISCLAIMER: This blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

July 24, 2025.

July 31, 2025.

If you have applied for the IPO but have not been allotted the Shares by the Registrar and are now looking for “ what to do if the IPO refund is not received ”, then we have covered the blog, which explains the steps to get your IPO refund. Click the link to explore.

Rs. 85 to Rs. 90.

Brigade Hotel Ventures IPO is the new IPO from Brigade Group that is set to open on 24 July 2025.