Home >> IPO >> Shanti Gold International IPO: Price, Valuation, And GMP

Shanti Gold International IPO: Price, Valuation, And GMP

Table of Contents

- Shanti Gold International IPO - Complete Overview

- Shanti Gold International IPO Details

- Company Financial

- The Objective of The Issue

- Peers of Shanti Gold International Ltd.

- Evaluation

- Evaluation of P/E Ratio

- IPO's Strengths

- IPO’s Weaknesses

- Promoters And Management of Shanti Gold International Ltd.

- Shanti Gold International IPO Lead Managers

- Dividend Policy

- Conclusion

Shanti Gold International IPO - Complete Overview

Shanti Gold International IPO, a Mainboard IPO, is a book-built issue of Rs. 360.11 Cr (1.81 Cr Shares) by Shanti Gold International Limited. The company was founded in 2003 and focuses on making high-end jewelry out of 22 carat gold, casting exquisite items in gold, and adding cubic zirconia to emphasize them. It gives both creative design and effective manufacturing equal weight.

It uses a completely vertically integrated structure that includes in-house design, manufacturing, and packaging facilities in order to maintain unwavering quality. This architecture enables quality surveillance from raw material entry to retail presentation.

Being equipped with a most sophisticated set of high-volume casting and machining machinery, it enables secondary craftsmen to do delicate operations, such as hand setting cubic zirconia, thus combining automated precision with hand crafting.

The factory at Mumbai, in Andheri East, is sprawling across 13448.86 sq ft and is calibrated to an average yearly production of 2700 kg of finished jewellery, in contrast to large-scale output and careful dimensional accuracy.

They have a specialised team of 80 CAD engineers who produce over 400 prototypes every month of gold articles intricately studded with cubic zirconia using advanced CAD packages to visualise the intricate geometries peculiar to modern jewellery.

Product:

-

Finely crafted jewelry.

-

Necklaces

-

Rings

-

Bangles

-

Matching sets for celebratory occasions and everyday wear, as well as ceremonial items for wedding ceremonies.

This new IPO is to be launched on 25 July 2025, and the initial public offering of this upcoming IPO will end on 29 July 2025.

If you want to apply for the IPO, click to open a Demat Account.

Shanti Gold International IPO Details

The Rs. 360.11 crore mainline IPO comprises a wholly fresh issue of 1.81 crore shares.

The IPO listing date is on Friday, 01 August 2025, and it will be listed at BSE and NSE. The Shanti Gold International IPO price band is Rs. 189 to Rs. 199 for each Share.

Company Financial

(Amount in Cr)

|

Period |

31 Mar 2025 |

31 Mar 2024 |

31 Mar 2023 |

|

Total Assets |

419.83 |

325.40 |

256.88 |

|

Total Revenue |

1,112.47 |

715.04 |

682.28 |

|

PAT |

55.84 |

26.87 |

19.82 |

|

Net Worth |

152.37 |

96.67 |

69.81 |

|

Borrowings |

233 |

210.68 |

165.34 |

Cash Flows

The cash flows for various activities are shown below:

(Amount in millions)

|

Net Cash Flow In Multiple Activities |

31 Mar 2025 |

31 Mar 2024 |

31 Mar 2023 |

|

Net Cash Flow Operating Activities |

(153.03) |

(130.26) |

(48.38) |

|

Net Cash Flow Investing Activities |

12.67 |

(50.75) |

(44.77) |

|

Net Cash Flow Financing Activities |

132.55 |

196.27 |

91.92 |

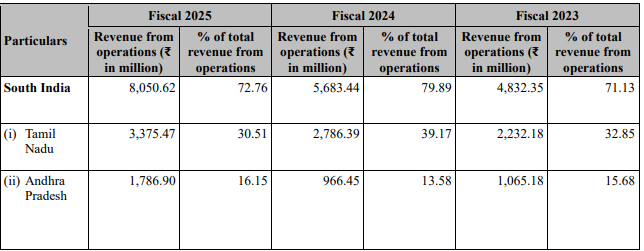

Geography-wise Revenue Breakdown

(Source RHP)

The Objective of The Issue

-

Financing the necessary capital expenditures to establish the proposed Jaipur facility.

-

Meeting the company's operating capital needs.

-

Full or partial repayment and/or prepayment of specific loans that the company has taken out.

-

General corporate purposes.

Click to check the IPO application status.

Detailed Video

Peers of Shanti Gold International Ltd.

|

Company Name |

Face Value (Rs.) |

EPS (Rs.) |

P/E (x) |

|

Utssav CZ Gold Limited |

10 |

11.63 |

19.35 |

|

RBZ Jewellers Limited |

10 |

9.70 |

14.42 |

|

Sky Gold Limited |

10 |

9.52 |

34.53 |

Evaluation

The Shanti Gold IPO price is between Rs. 189 to Rs. 199 for each Share.

Evaluation of P/E Ratio

Considering the period of FY 2025, with an EPS of Rs. 10.34 from the last year, the resulting P/E ratio is 19.24x.

Considering the weighted EPS of Rs. 7.44 for the last three years, the P/E ratio is 26.74x.

Explore the GNG Electronics IPO.

Comparative Analysis With Listed Peers

The average P/E Ratio of the industry is 24.48x.

|

Particulars |

P/E Ratio (x) |

|

Highest |

34.53 |

|

Lowest |

14.42 |

|

Average |

24.48 |

In simple words, the P/E ratio of this IPO is 19.24x, compared with the industry’s average P/E of 24.48x, indicating an undervaluation (on a P/E ratio basis only). Hence, the price of the Share seems fully priced for the investors when considered based on the average P/E ratio of the industry.

IPO's Strengths

-

A wide range of jewelry collections created by a committed group of experts.

-

Vertically integrated, end-to-end production: ensuring quality at every turn.

-

Veteran promoters equipped with operational execution expertise.

-

Sound financial structure underpinning sustainable growth.

-

Long-standing partnerships with corporate entities and the jewellery trade.

IPO’s Weaknesses

-

The majority of the company’s operational and revenue-generating activities continue to be concentrated in Southern India, a region that produced 72.76% of its revenue from Fiscal 2025. Such geographic concentration exposes the company to the effects of regional economic cycles.

-

The product mix is currently heavily skewed towards 22kt cubic zirconia jewellery, and a portion of the Net Proceeds is earmarked for financing capacity expansion for a new line of machine-made plain gold jewellery, which is intended to be manufactured at the Proposed Jaipur Facility.

-

The dependence on gold as a principal raw material subjects the Company to the dual risk of price volatility and changing demand patterns. Any prolonged non-availability of gold of acceptable quality could distort the cost structure.

Shanti Gold International IPO GMP

Shanti Gold International IPO GMP today is Rs. 0 as of 21 July 2025, while writing this information. Hence, its estimated listing price is Rs. 199 (upper price + current GMP).

Shanti Gold International IPO Timetable (Tentative)

The IPO open date is from Jul 25 to Jul 29, with IPO allotment on Jul 30, refund initiation on Jul 31, and listing on Friday, Aug 01, 2025.

|

Events |

Date |

|

IPO Opening Date |

Jul 25, 2025 |

|

IPO Closing Date |

Jul 29, 2025 |

|

IPO Allotment Date |

Jul 30, 2025 |

|

Refund Initiation |

Jul 31, 2025 |

|

IPO Listing Date |

Aug 01, 2025 |

Shanti Gold International IPO Details

The IPO with a face value of Rs. 10 per Share offers a total issue size of 1,80,96,000 Shares (Rs. 360.11 Cr) and will be listed at BSE and NSE.

|

IPO Opening & Closing Date |

Jul 25, 2025 to Jul 29, 2025 |

|

Face Value |

Rs. 10 per Share |

|

Issue Price |

Rs. 189 to Rs. 199 |

|

Lot Size |

75 Shares |

|

Issue Size |

1,80,96,000 Shares (Rs. 360.11 Cr) |

|

Offer for Sale |

- |

|

Fresh Issue |

1,80,96,000 Shares (Rs. 360.11 Cr) |

|

Listing At |

BSE, NSE |

|

Issue Type |

Book Built Issue IPO |

|

Registrar |

Bigshare Services Pvt Ltd. |

Shanti Gold International IPO Lot Size

The IPO allows retail investors to invest in a minimum and maximum of 1 Lot (75 Shares) amounting to Rs. 14,925 and 13 Lots (975 Shares) amounting to Rs. 1,94,025, respectively, while for HNI investors, the minimum Lot is 14 (1050 Shares) amounting to Rs. 2,08,950.

|

Minimum Lot Investment (Retail) |

1 Lot |

|

Maximum Lot Investment (Retail) |

13 Lots |

|

S-HNI (Minimum) |

14 Lots |

|

S-HNI (Maximum) |

67 Lots |

|

B-HNI (Minimum) |

68 Lots |

Shanti Gold International IPO Reservation

|

Institutional Share Portion |

50% |

|

Retail Investors' Share Portion |

35% |

|

Non-Institutional Shares Portion |

15% |

Promoters And Management of Shanti Gold International Ltd.

-

Pankajkumar H Jagawat

-

Manojkumar N Jain

-

Shashank Bhawarlal Jagawat.

|

Pre-Issue Promoter Shareholding |

99.99% |

|

Post-Issue Promoter Shareholding |

74.89% |

Shanti Gold International IPO Lead Managers

-

Choice Capital Advisors Pvt Ltd.

Dividend Policy

The company has paid no dividends in the last three fiscal years.

Conclusion

Shanti Gold International IPO strategically targets India’s high-end gold jewellery market, leveraging an integrated production framework alongside well-established retail alliances. Concentration of sales in specific locations and reliance on a narrow product line introduce operational vulnerabilities.

Finowings IPO Analysis

Hope you enjoyed the Finowings IPO Analysis. We tried our best to give every required detail about the company that you should know before applying to the IPO.

You must consult your financial advisor before making any financial decisions.

To Apply for the IPO, Click Here.

To Read the Prospectus of the Company Click Here to Download the DRHP.

Click Here To Stay Updated With The Upcoming IPOs.

DISCLAIMER: This blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

Pankajkumar Hastimal Jagawat and Manoj Kumar Jain are among the promoters and owners of Shanti Gold Ltd.

July 25, 2025.

August 01, 2025.

If you have applied for the IPO but have not been allotted the Shares by the Registrar and are now looking for “ what to do if the IPO refund is not received ”, then we have covered the blog, which explains the steps to get your IPO refund. Click the link to explore.

Rs. 189 to Rs. 199.