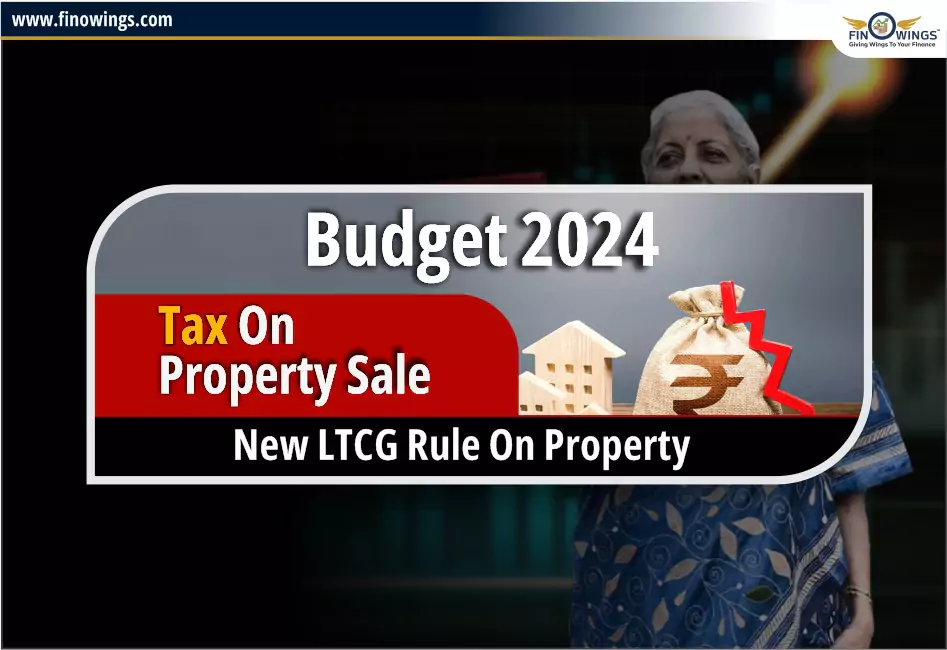

Home >> Blog >> Budget 2024 - Tax on property sale: New LTCG Rule on Property

Budget 2024 - Tax on property sale: New LTCG Rule on Property

Table of Contents

Introduction to Property Tax Changes

The recent budget has introduced significant changes to property taxes, impacting both traders and investors. Many believed that investing in property would yield substantial profits, but new tax regulations have led to increased liabilities. This article will explore how these changes affect property owners and investors, focusing on the long-term capital gains (LTCG) tax and the implications of removing indexation benefits.

The Impact of New Tax Regulations

With the introduction of new tax rates, property owners are facing a stark reality. The government has decided to impose taxes on the total profit amount when selling property, eliminating the previously available indexation benefits. This shift is expected to result in higher tax payments for homeowners and investors alike.

Understanding Long-Term Capital Gains (LTCG) Tax

The long-term capital gains tax is a crucial component of property transactions. Under the new regulations, the LTCG tax will apply to the entire profit amount from property sales. Previously, property sellers benefited from indexation, which adjusted the purchase price against inflation, thereby reducing taxable gains.

What is Indexation?

Indexation plays a vital role in calculating gains or losses from property investments. It allows property owners to adjust the purchase price based on the inflation rate over the years. This adjustment is made using the Cost Inflation Index (CII), which the government updates annually. Without indexation, property owners face higher tax liabilities, as they cannot account for inflation in their profit calculations.

Comparing Old and New Tax Calculations

To illustrate the differences between the old and new tax calculations, let’s consider a hypothetical scenario where a property was purchased for ₹28 lakhs in 2009 and sold for ₹65 lakhs in 2024.

Old Tax Calculation with Indexation

Under the old system, the calculation involved determining the indexed cost of acquisition. The CII for 2009 was 137, and for 2024, it is 348. The formula for calculating the indexed cost is:

Indexed Cost = (CII of Sale Year / CII of Purchase Year) * Cost Price

Plugging in the numbers:

- CII of Sale Year (2024): 348

- CII of Purchase Year (2009): 137

- Cost Price: ₹28,00,000

Using the formula, the indexed cost comes out to approximately ₹71,12,200. Thus, the capital gain is:

Capital Gain = Sale Price - Indexed Cost = ₹65,00,000 - ₹71,12,200 = -₹6,12,200

Since there is a loss, no tax is owed.

New Tax Calculation without Indexation

With the new regulations, the indexation benefit has been removed. The calculation is straightforward:

Capital Gain = Sale Price - Purchase Price = ₹65,00,000 - ₹28,00,000 = ₹37,00,000

This entire gain of ₹37 lakhs is now subject to LTCG tax at 20%, leading to a tax liability of:

Tax Liability = 20% of ₹37,00,000 = ₹7,40,000

This stark contrast shows how the removal of indexation can significantly increase tax burdens on property owners.

Detailed Video

Real-Life Implications for Homeowners

These changes have far-reaching implications for homeowners. Many individuals who relied on property investments for financial security may now find themselves facing unexpected tax liabilities. The new tax structure could discourage property sales, as the potential tax burden may outweigh the benefits of selling.

Effects on Property Prices

As tax liabilities increase, property prices may also be affected. Potential buyers may hesitate to invest in properties with high tax implications, leading to a slowdown in the real estate market. This could create a ripple effect, impacting not only property sellers but also the overall economy.

Conclusion: Navigating the New Tax Landscape

The changes introduced in Budget 2024 represent a significant shift in how property transactions are taxed. Property owners must adapt to the new regulations to avoid unexpected financial burdens. Understanding the implications of these changes is crucial for anyone involved in property investments.

What Should Property Owners Do?

Property owners should consider the following steps to navigate the new tax landscape effectively:

- Consult a tax professional

- Evaluate the timing of property sales

- Consider long-term property holding strategies

- Stay informed about future tax changes

By taking proactive measures, property owners can mitigate the impact of these tax changes and make informed decisions about their investments.

Author

Frequently Asked Questions

The recent budget has introduced significant changes, including the imposition of taxes on the total profit amount from property sales and the elimination of indexation benefits.

Without indexation, property owners cannot adjust the purchase price for inflation, resulting in higher taxable gains and increased tax liabilities when selling property.

The LTCG tax applies to the entire profit amount from property sales. Under the new regulations, this tax is calculated without considering indexation, leading to higher tax payments for property sellers.

Increased tax liabilities may discourage property sales, potentially leading to a slowdown in the real estate market as buyers hesitate to invest in properties with high tax implications.

Property owners should consult tax professionals, evaluate the timing of property sales, consider long-term holding strategies, and stay informed about future tax changes to mitigate the impact of the new regulations.