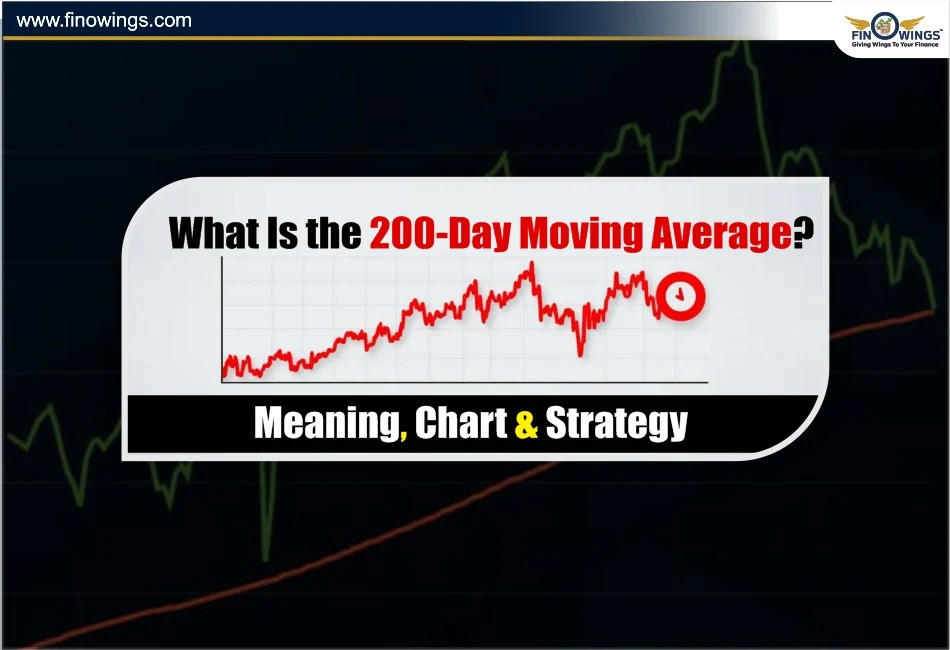

Home >> Blog >> What Is the 200-Day Moving Average? Meaning, Chart & Strategy

What Is the 200-Day Moving Average? Meaning, Chart & Strategy

Table of Contents

Among various indicators used in trading, the 200-day moving average (200 DMA) is one of the most common. It is well understood by industry experts, as well as novices in the field. Whenever one is trading stocks, crypto, or any other commodity, this indicator helps recognise long-term trends and helps one avoid false signals, thereby assisting in better decision-making.

In this blog, we will discuss the 200 DMA in depth, how the 200-day moving average chart assists decision-making, and some strategies in the domain of trading and investing.

What Is 200-Day Moving Average?

The 200-day moving average (200 DMA or 200 MA) is an indicator that finds the average closing value of an asset, stock, or index over the last 200 trading days.

It takes a more expansive, less volatile view of the market to allow one to see long-term trends by filtering short-term, minor fluctuations. It helps an investor discern when long-term uptrends or downtrends are occurring.

Why 200 Days?

The figure 200 does not come randomly. It represents around one trading year (about 200 market days). This average is tracked by global investors and institutions as a key long-term performance benchmark.

200 DMA is optimal for long-term investing. This is because 200 DMA is a long-term average that focuses on "long-term price movement sustainability".

How Is the 200-Day Moving Average Calculated?

The 200-day moving average (200 DMA) is calculated as follows:

200 DMA = (The sum of daily closing prices for the previous 200 days)

Each day, the most outdated closing price is removed from the average, and the most recent closing price is added. This is why it is called a moving average.

Reading the Moving Average 200-Day Chart

A smooth line that tracks an asset's price can be seen on a 200-day moving average chart. A summary of the trend direction is provided by this 200-day line.

The chart can be read as follows:

-

The trend is upward (bullish) when the price is above the 200 DMA line.

-

The price is in a negative falling trend when it is below the 200 DMA line.

-

A potential trend reversal is indicated when the price passes the 200 DMA line.

Example

If the Nifty 50 rises above its 200-day moving average chart after trading below it for a considerable period of time, traders consider this to be a certain indicator of positive upward momentum.

Significance of 200 Moving Average

The 200 Moving Average is one of the most respected technical levels across global markets.

1. Support and Resistance.

When prices are stagnant, many traders view the 200 DMA line as a powerful support or resistance level. Prices often bounce back from this line before breaking decisively.

2. Institutional Investors' Benchmark.

Large funds, mutual funds, and foreign institutional investors (FIIs) often monitor the 200 DMA as a way to justify their buy or sell decisions.

3. Market Sentiment.

A 200-day moving average price below indicates market weakness, but the majority of companies in an index trading above it indicate market strength.

4. Filtering out noise.

By removing the daily price fluctuations, the indicator makes it easier for traders to detect the trend.

5. Universality.

The 200 moving average is applicable to all markets, including cryptocurrency, forex, and stocks.

Popular 200 DMA Trading Strategies

Let’s discuss some simple and effective 200-day moving average strategies for trading and investing.

1. Price Crossover Strategy

Buy Signal: The price > 200 DMA → uptrend.

Sell Signal: A price < 200 DMA → downtrend.

Example: When Reliance Industries' price was increased after weeks of consolidation and crossed its 200 DMA, many traders expected a bullish breakout.

2. Moving Average Crossover Strategy

50-day MA for short-term and 200-day MA for long-term are used in this technique.

Golden Cross: A buy signal → 50-day MA crosses over the 200 MA.

Death Cross: A sell signal → 50-day MA crosses below the 200 MA.

This approach is commonly used in equity indices and blue-chip stocks.

3. Trend-Following Strategy

-

When prices are above the average, hold or add to your position.

-

When prices are below, exit or do not enter. This simple rule allows you to avoid large losses during drastic market declines.

4. Support and Resistance Bounce Strategy

Traders can use the 200-day moving average as a dynamic support or resistance. When the price bounces off the 200 DMA line, traders can enter a position.

Example:

If a stock is increasing in price and makes a correction down to the 200 Day Moving Average and then makes a rebound, it is often considered a buy-the-dip opportunity.

5. Confirmation Strategy with RSI or Volume

200 moving average is a versatile tool in combination with other indicators such as RSI (Relative Strength Index) or volume. For example:

When a stock is moving strongly with a high volume and RSI is greater than 60 after breaking the 200 DMA, that is a confirmation of bullish momentum. Bearish pressure is confirmed when a stock breaks the 200 DMA lower and exhibits significant volume.

Mistakes to Avoid

Depending solely on 200 MA: Signals must always be confirmed with volume or other indicators.

Ignoring Context: Market news, earnings, or macro events can override technical levels.

Using 200 DMA for Short-Term Trades: The 200 DMA is a long-term trend tool, and should not be used for quick scalping.

Failing to Adjust Risk: Long-term trends must still have stop-losses set to minimise the effect of risk.

Not Reassessing: The 200 DMA must be recalculated, and its slope must be monitored.

Best Platforms to View 200-Day Moving Average Charts

The following platforms can be used to view and create 200-day moving average charts with ease:

- TradingView (offers personal MA indicators)

- Investing.com

- Websites of NSE India or BSE India

- Charting tools on Zerodha Kite / Upstox Pro

The above platforms give you the convenience to overlay 200 moving average on any asset and compare it with other indicators.

Conclusion

The 200-day moving average is simply more than a line on a chart. Investing in it means taking a special interest in the long-term health of the market and seeing how the long-term investors feel about it. Knowing how to use what is 200 DMA to your advantage can clear the market noise, allowing you to follow a trend and make rational decisions that can save you a ton of money.

Even if you are new to trading, expertise needs a 200-day moving average chart, and it needs to be a part of your strategy. The chart will help you pinpoint important market changes. The key to that is patience and discipline. Successful trading is all about staying with the trend, not fighting it.

DISCLAIMER: This blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

The 200 DMA shows the long-term trend of a stock, index, crypto, or commodity. If the price stays above the 200-day moving average, it suggests a bullish trend. If it stays below, it indicates a bearish or weakening trend.

The 200 DMA is trusted because it filters out short-term volatility and identifies real long-term momentum. Large institutions, FIIs, mutual funds, and global traders also track the 200-day line, making it a major support and resistance level.

The 50-day MA shows short-term trend strength, while the 200-day MA reflects long-term trend direction. When the 50-day MA crosses above the 200-day MA, it forms a “Golden Cross” (bullish signal). When it crosses below, it forms a “Death Cross” (bearish signal).

The 200 DMA is mainly a long-term indicator, so it’s less effective for intraday scalping. However, short-term traders still use it for major support/resistance levels and strong breakout confirmation.

Common mistakes include using it without confirming signals, ignoring volume, relying only on the moving average during news-driven markets, using 200 DMA for fast trades, and neglecting risk management or stop-loss levels.