Home >> Blog >> Iron Butterfly (Iron Fly) Options Strategy Explained: Full Guide

Iron Butterfly (Iron Fly) Options Strategy Explained: Full Guide

Table of Contents

- What Is Iron Butterfly (Iron Fly) Strategy?

Structure of the Iron Butterfly Options- Example of Iron Butterfly (Iron Fly) Strategy

- How Iron Butterfly Strategy Works

- Iron Butterfly Payoff Diagram

- Iron Butterfly Strategy Uses

- Iron Butterfly Options Strategy Advantages

- Iron Butterfly Options Strategy Cons

- Iron Fly vs Iron Condor

- Iron Fly Adjustments

- Trading the Iron Butterfly Options

- Final Thoughts

In options trading, each trader tries to achieve balance between a ‘reward’ and a ‘risk’. Among the most popular non-directional strategies that profit in range-bound markets is the ‘Iron Butterfly strategy’, also known as ‘Iron Fly’.

Have you ever wondered ‘what is Iron Butterfly’, how ‘iron fly options strategy’ works or how to effectively use it for a consistent income? Look no further, as this guide breaks it all down in the simplest possible way.

What Is Iron Butterfly (Iron Fly) Strategy?

Iron Butterfly or ‘Iron Fly strategy’ is a neutral options strategy that earns a profit when the underlying asset, like Nifty or Bank Nifty, stays within a particular strike price until expiry. In simpler terms, it is a ‘combination of a bull put spread and a bear call spread, with the same expiry’. This position allows you to earn from ‘time decay (theta)’ and have a limited loss.

The Iron Fly earns a profit when volatility reduces and the stock stays between a particular range.

Simple Definition:

The Iron Butterfly strategy entails selling an at-the-money (ATM) call and put and purchasing one out-of-the-money (OTM) call and one OTM put for protection.

Structure of the Iron Butterfly Options

The strategy has four legs - hence the name, "Iron."

|

Leg |

Action |

Strike Price |

Option Type |

|

1 |

Buy |

Lower Strike |

Put |

|

2 |

Sell |

At-the-Money |

Put |

|

3 |

Sell |

At-the-Money |

Call |

|

4 |

Buy |

Higher Strike |

Call |

The short ATM call and put create a "body," and the two long OTM options form the "wings" - visually resembling a butterfly, hence the name Iron Butterfly options.

Example of Iron Butterfly (Iron Fly) Strategy

Let’s understand it with a practical example.

Imagine Nifty is trading at ₹22,000. You expect it to remain between ₹21,850 and ₹22,150 until expiry. You create the Iron Fly strategy like this:

|

Leg |

Action |

Strike Price |

Type |

Premium (₹) |

|

1 |

Buy |

21,850 |

Put |

60 |

|

2 |

Sell |

22,000 |

Put |

120 |

|

3 |

Sell |

22,000 |

Call |

130 |

|

4 |

Buy |

22,150 |

Call |

70 |

Net Credit (Premium Received) = ₹120 + ₹130 − ₹60 − ₹70 = ₹120

This ₹120 is your maximum possible profit - achieved if Nifty stays close to ₹22,000 until expiry.

How Iron Butterfly Strategy Works

Here’s the breakdown of how the Iron Butterfly option strategy works:

-

If the underlying stays near the middle strike (22,000), both sold options (call and put) lose value quickly, giving you profit from time decay.

-

If the price moves sharply above or below your wings (22,150 or 21,850), your losses are limited to the difference between the strikes minus the net credit received.

-

Thus, between the two breakeven points, the profit zone can be determined and the risk is limited.

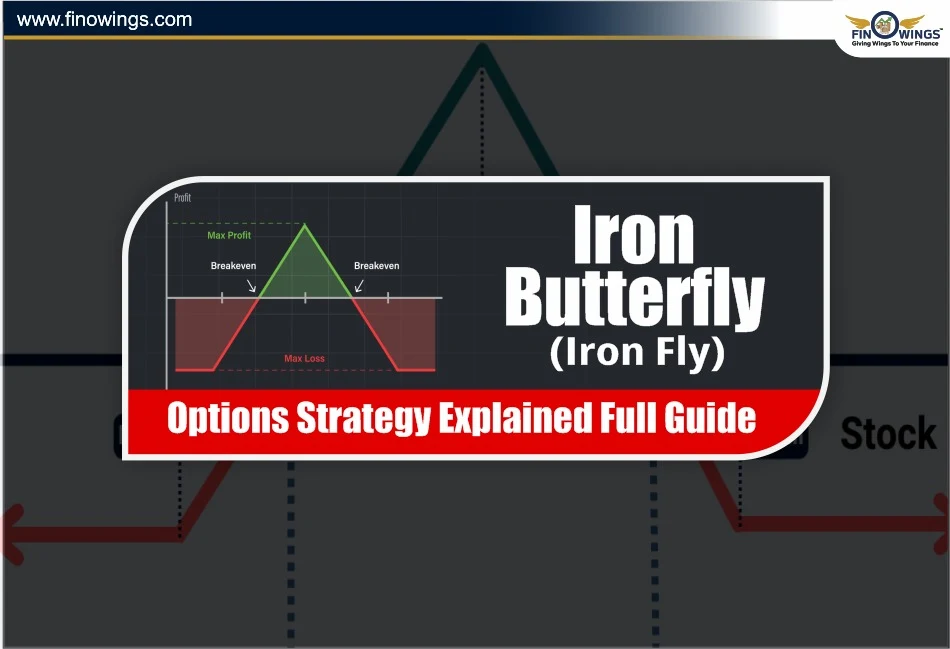

Iron Butterfly Payoff Diagram

The Iron Butterfly payoff chart is shaped like a tent or a butterfly — wide wings and a narrow peak in the middle.

Key Profit–Loss Levels:

Maximum Profit: Occurs when the underlying closes at the middle strike (ATM).

Profit = Net Premium Received

Maximum Loss: Occurs if the underlying breaches either wing.

Calculating Loss in Analytics

Loss = Difference between adjacent strike prices - Net Premium Received

Breakeven Points:

Lower Breakeven = Lower Strike + Net Credit

Upper Breakeven = Higher Strike - Net Credit

For an option seller, this is one of the most controlled iron fly strategies due to the defined risk/reward setup.

Iron Butterfly Strategy Uses

The Iron Butterfly Strategy is most effective in low-volatility, sideways markets. This is when you expect the market price to stay within a range until expiry.

Use it when:

- Market volatility is low or expected to reduce.

- There are no significant events in the near future (like elections, Fed decisions or a budget).

- The stock/index is trading within a strong support or resistance zone.

Iron Butterfly Options Strategy Advantages

1. Defined Reward and Limited Risk- Excellent risk management because loss and gain are both capped.

2. Profits from Time Decay (Theta)- Time still works in favour of Iron Fly sellers as the option premium reduces near expiry.

3. Stable Returns for Range-Bound Markets- Little movement is ideal and preferred for sideways markets.

4. High Probability of Success- Even within a tight range, profit is made through premium decay.

Iron Butterfly Options Strategy Cons

1. Limited Profitability – Your profit will be limited to the net premium received.

2. Requires High Margin – Significant capital is needed to short ATM options.

3. High Sensitivity to Volatility – Rapid increases in volatility such as the VIX may lead to losses.

4. Need for Active Monitoring – Requires constant attention to price movement, as well as implied volatility.

Iron Fly vs Iron Condor

|

Feature |

Iron Butterfly (Iron Fly) |

Iron Condor |

|

Middle Strikes |

Same (ATM call & put sold) |

Different (OTM call & put sold) |

|

Profit Range |

Narrower, higher return |

Wider, lower return |

|

Risk Level |

Slightly higher |

Slightly lower |

|

Market View |

Very range-bound |

Mildly range-bound |

Choose the Iron Condor for higher probabilities, although the returns will be lower. Opt for the Iron Butterfly if you want higher credit with lower range profit.

Iron Fly Adjustments

The need for adjustments is important because the markets will never be stagnant.

1. If the Market Moves Up- The lower put spread will need to be adjusted, so you will roll up to collect more premium.

2. If the Market Goes Down- Adjust the upper call spread to the new price.

-

If Volatility Increases- Cut down on your position or leave to prevent excessive margin growth.

-

Smartly managing your adjustments can turn a losing iron fly strategy into a breakeven point or a small profit.

Trading the Iron Butterfly Options

-

Trade high liquidity options like Nifty, Bank Nifty, or FinNifty.

-

Do not trade around key announcements or events.

-

Always pay attention to implied volatility (IV). Start a trade when IV is high and expected to drop.

-

Realise profits early if you have already reached 50–60% of your maximum profit and are close to the expiry date.

Final Thoughts

For disciplined traders, the Iron Butterfly (Iron Fly) options strategy is a great range-bound strategy to implement. It is the combination of the spread's stability with the profitability of time decay.

Seeing what is Iron Butterfly, its adjustments, payoff, and its techniques can really help traders make income while keeping losses down. If you are using the iron fly strategy, you should make sure to execute solid risk management, as it will yield consistent results and will remain on your options-selling strategy.

DISCLAIMER: This blog is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.

Author

Frequently Asked Questions

The Iron Butterfly strategy, also called Iron Fly, is a neutral options trading setup that profits when the underlying asset (like Nifty or Bank Nifty) stays within a specific price range. It combines a bull put spread and a bear call spread with the same expiry to earn from time decay while keeping losses limited.

The Iron Fly makes money when the stock or index stays near the middle strike price until expiry. Both the sold call and put options lose value due to time decay (theta), allowing the trader to keep the net premium received as profit.

The Iron Butterfly has limited profit and limited risk.

-

Maximum Profit: Equal to the net premium received if the price closes at the middle strike.

-

Maximum Loss: The difference between adjacent strike prices minus the net premium received.

The Iron Fly is best used in low-volatility, sideways markets when you expect the price to stay within a tight range. It’s ideal when no major events or news are expected to move the market significantly.

Both are range-bound strategies, but:

-

The Iron Butterfly sells at-the-money (ATM) options, offering higher profit but a narrower range.

-

The Iron Condor sells out-of-the-money (OTM) options, giving lower profit but a wider range and slightly less risk.